AMD (AMD) launched its MI350 line of AI chips and detailed its next-generation MI400 line of GPUs as part of its Advancing AI event in San Jose, Calif., on Thursday.

The company also unveiled its AMD Developer Cloud, which gives developers access to the company’s AI processors via its cloud computing infrastructure.

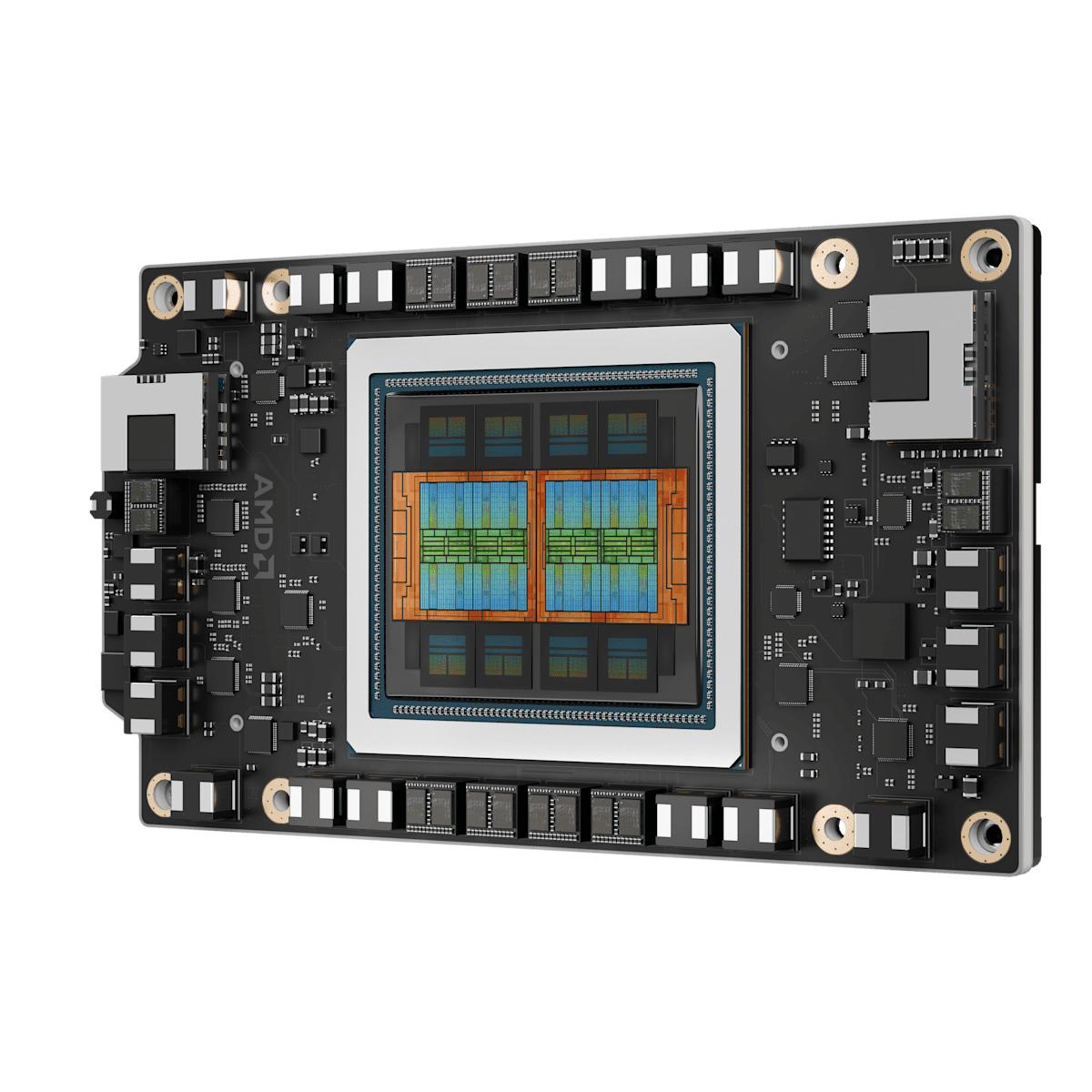

The MI350 line includes both the MI350X and MI355X and is designed to go head-to-head with Nvidia’s (NVDA) Blackwell line of AI chips. AMD says the processors offer up to four times the AI compute performance and a 35x increase in inferencing capabilities versus its prior-generation MI350 chips.

Each chip offers 288GB of HBM3E memory, more than the 192GB of memory found in Nvidia’s Blackwell GPU. But Nvidia pairs two Blackwell GPUs in its GB200 superchip, meaning it actually comes with 384GB of memory.

AMD said users can opt for either individual MI350x and MI355X chips or its MI350X and MI355X platforms, which combine 8 GPUs each for up to 2.3TB of memory.

MI350 systems with up to 64 GPUs can be air cooled, meaning they’ll use fans to keep from burning up, while MI350 systems of 128 GPUs can use liquid cooling, which involves running a coolant through a series of pipes and radiators to cool the chips.

In addition to the MI350 launch, AMD revealed more information about its MI400 line of chips, which it said will launch in 2026.

According to the company, the GPUs will feature up to 432GB of HBM4 and memory speeds of up to 19.6TB per second. Those chips will compete with Nvidia’s GB300 Blackwell Ultra processors and its upcoming Rubin AI GPU.

AMD also showed off its new AMD Developer Cloud. The service will allow users to log into AMD’s platform to quickly gain cloud access to its line of MI300 and MI350 GPUs. The option gives developers who need to use high-powered chips for AI training and inferencing the ability to take advantage of the hardware without having to purchase it themselves.

Nvidia launched a similar service called Nvidia DGX Cloud Lepton last month.

AMD’s stock has struggled over the past year, falling roughly 24% in the past 12 months. Nvidia’s stock rose more than 19% in the same period. Year to date, AMD is off 0.2%, while Nvidia is up 7%.

AMD, like Nvidia, was stung by write-downs related to the Trump administration’s export controls on AI chips destined for China. The company says it expects to take an $800 million hit from the ban. Nvidia, meanwhile, was forced to write down $4.5 billion due to the controls and said it expects to miss out on $8 billion in sales in its fiscal second quarter.