Quick overview

- Bitcoin is currently trading above $105,000 but struggles to break the $109,000-$110,000 resistance zone.

- The cryptocurrency is experiencing a consolidation phase amid selling pressure from long-term holders and strong institutional demand through ETFs.

- On-chain data shows significant profit realizations by long-term holders, yet Bitcoin’s price remains stable due to steady demand from new buyers.

- Historically, July has been a favorable month for Bitcoin, with potential for a rally if it can break key resistance levels.

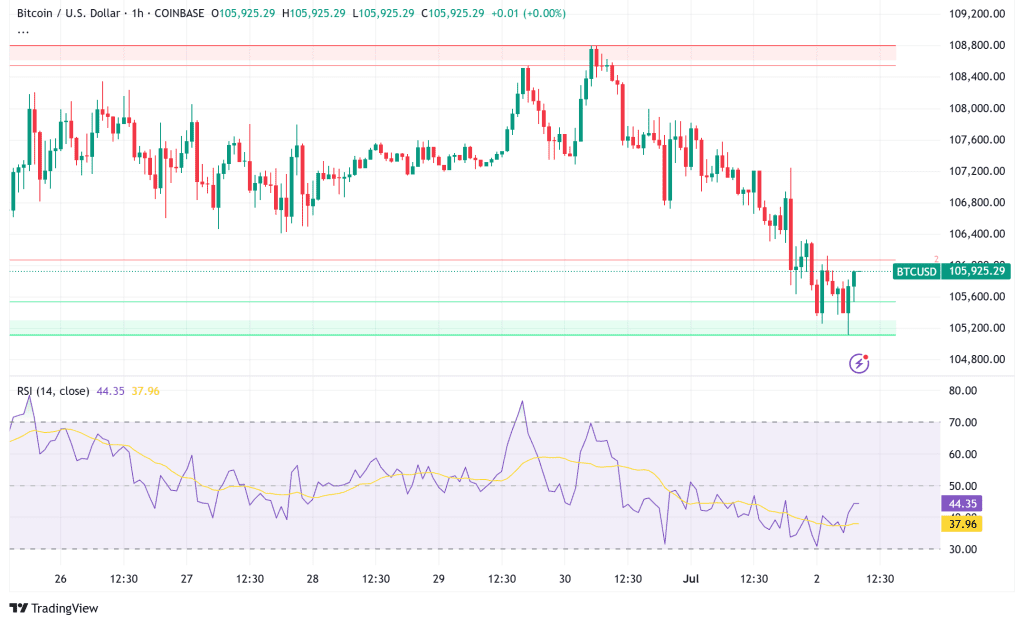

Bitcoin BTC/USD is still trading above the $105,000 barrier, which is significant for the mind. It is currently at about $105,889, a small 1.2% loss over the last 24 hours. However, the top cryptocurrency is having a hard time breaking past the $109,000-$110,000 barrier zone that has kept it from going up since late May.

The present consolidation phase is happening in a complicated market where institutional demand through ETFs is fighting against long-term investors who want to take their profits. This has left Bitcoin stuck between $100,000 and $110,000.

BTC/USD Technical Analysis: Key Support Levels Under Pressure

Bitcoin’s price movement reveals signals of weakness from a technical point of view. The cryptocurrency has fallen below two important support levels, and analysts say it looks more and more likely that it will go back to the $100,000 mark. The daily chart shows that Bitcoin is stuck between a downtrend line and moving averages. This could mean that the price will move up or down in the next several days.

The relative strength index (RSI) is close to the middle, which means there isn’t a strong positive trend. If Bitcoin can’t stay above its moving averages, the next big support levels to look for are $104,500 and then the psychological floor of $100,000. Analysts say that this kind of drop would lock the cryptocurrency in a negative descending triangle pattern.

Bitcoin has already broken below its moving averages on the 4-hour time frame, which means that short-term traders are taking profits. A break over the 20-day exponential moving average would be the first sign of fresh strength. This might open the door for a rally back to the downtrend line resistance.

BTC/USD

On-Chain Dynamics: Whales and Long-Term Holders Drive Market Activity

Even though there are technological issues, on-chain data tells an interesting story about how the industry is changing. Long-term holders have been selling a lot of coins, making $849 million in earnings on coins that are 3 to 5 years old and $485 million on coins that are 7 to 10 years old. Recently, daily realized profits reached $2.46 billion, and the seven-day average rose to $1.52 billion.

On June 16, there was a huge profit realization event that was especially noteworthy. Binance alone made almost $2.6 billion in earnings, making it the second-largest spike of its kind on the platform. This action right away caused selling pressure and a reaction in the market, showing how much whale behavior may affect price changes.

Analysts, on the other hand, see this redistribution as possibly helpful. Even if long-term holders are selling steadily, Bitcoin’s price has stayed very stable. This suggests that the market is successfully absorbing the selling pressure through steady demand from new buyers.

Institutional Adoption: Bitcoin ETF Inflows Provide Strong Support

Institutional demand through exchange-traded products is unprecedented, which is helping to balance off the selling pressure from long-term investors. Cumulative net inflows to worldwide Bitcoin ETPs have hit a record high of $14.3 billion this year. US spot ETFs are currently on a 14-day winning streak that could break the 16-day record set immediately after inception in early 2024.

Along with institutional buying, corporate treasuries have also started to buy Bitcoin. In late June, MicroStrategy led the way by adding another 4,980 Bitcoin worth about $531 million. At current pricing, the business has 597,325 BTC worth more than $64 billion. This is about 3% of all Bitcoin that has ever been mined.

Market Outlook: July Historically Favors Bitcoin Rally

Several things point to Bitcoin’s possible rise in the future. Since 2013, Bitcoin has had an average return of 7.56% in July, making it the best month for the currency. It has gained eight times in 12 periods. The cryptocurrency’s relationship with traditional risk assets, especially the S&P 500, suggests that better macroeconomic conditions could provide it further support.

Bitwise’s most recent report suggests that Bitcoin is poised for a “perfect storm,” as their Cryptoasset Sentiment Index has reached its highest level since May. The firm calls the combination of lower geopolitical concerns, possible monetary policy stimulus, and constant ETF inflows “a significant tailwind for Bitcoin and other crypto assets.”

Bitcoin Price Prediction: Range-Bound Trading with Breakout Potential

Bitcoin seems likely to stay in a range between $100,000 and $110,000 for the time being as the market continues to deal with the selling of long-term holders. The $109,000-$110,000 level of resistance is quite important, and there is almost $50 million in liquidity at $109,500.

If Bitcoin can get over the $110,000–$112,300 zone, it might start a short squeeze that pushes prices up to new all-time highs above the last peak of $111,980. Technical analysts say that any big breakthrough might happen in the next 30 to 40 days. This could cause a quick rise to the $140,000 to $150,000 range before the market settles down again.

If Bitcoin doesn’t hold its present support levels, it might test the $100,000 psychological support level. This level is very important symbolically, and there is a lot of institutional demand for it, so it would probably attract a lot of purchasing activity.