Bitcoin slipped back to July levels; Russia’s central bank moved to tighten oversight of banks’ dealings in digital assets; the TRON community backed a 60% fee cut; and other highlights of the week.

Bitcoin sheds its summer gains

On Monday the price of digital gold fell towards $111,000. In the subsequent correction, it slid below $110,000.

A brief attempt to reclaim prior levels soon faded; on Saturday, August 30th, the asset broke below $108,000. At the time of writing bitcoin trades around $108,300. By end-August the cryptocurrency had surrendered its summer bull run and returned to early-July marks.

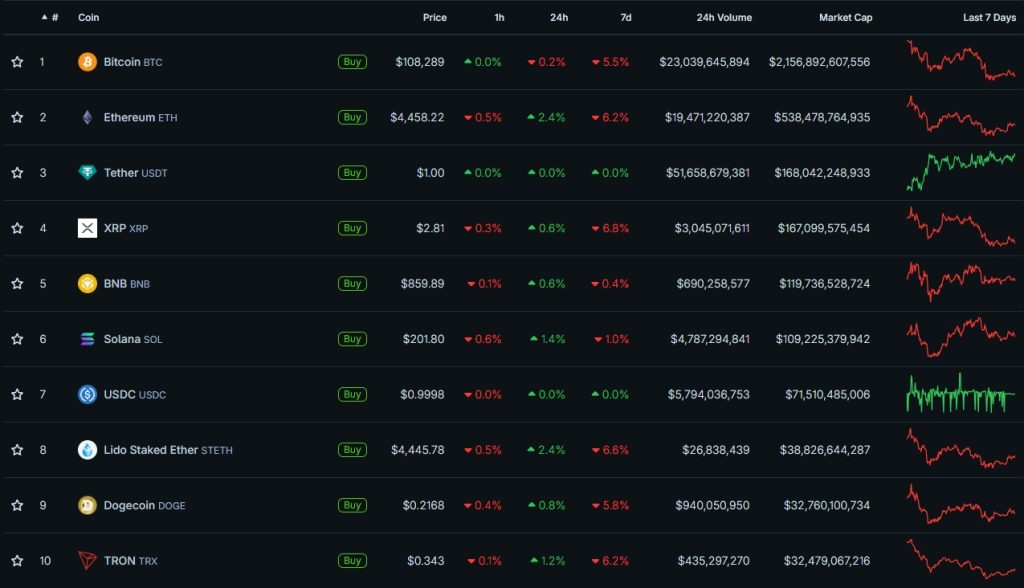

Over the week the bellwether fell 5.5%. Most leading altcoins moved similarly: XRP lost 6.8%, Ethereum declined 6.2%, and Dogecoin and TRON dropped 5.8% and 6.2%, respectively.

BNB (-0.4%) and Solana (-1%) ended the week roughly flat.

Crypto market capitalisation fell to $3.85trn; bitcoin’s dominance slipped to 55.9%.

Against this backdrop, the altseason index by CoinMarketCap rose from 44 to 57. Still, the reading lags far behind the 87 out of 100 seen early in the year.

The crypto fear-and-greed index remains neutral at 48.

Russia’s central bank to tighten oversight of banks’ crypto investments

The Bank of Russia will tighten regulation of credit institutions’ operations with cryptoassets. The central bank will require digital assets to be reflected in capital calculations and prudential ratios.

The rules will cover direct investments in cryptocurrencies as well as derivatives based on them.

Andrey Tugarin, founder of the law firm GMT Legal, said in a comment to ForkLog that the forthcoming changes merely formalise the regulator’s already conservative approach.

Ani Aslanyan, creator of the Telegram channel “Everything about blockchain, the brain and WEB 3.0 in Russia and the world”, saw the initiative as a direct threat to part of the banking business.

Rising compliance and monitoring costs could temporarily dampen institutions’ appetite for crypto. Smaller banks may exit the segment entirely, while stricter rules could push clients towards unregulated platforms, she added.

By contrast, Fyodor Ivanov, head of analytics at Shard, called the central bank’s move “a powerful leap in regulation”. He doubted, however, that it would be possible to catch up with global standards under current conditions.

What to discuss with friends?

- ZachXBT called Ripple, Cardano and Hedera “insider enrichment schemes”.

- Superintelligent AI could become a catastrophe — Vitalik Buterin.

- Bitfinex outlined the condition for the start of a broad altseason.

- An analyst predicted Ethereum’s rally will end in September.

Buterin proposes new ways to safeguard Ethereum’s decentralisation

Ethereum’s founder, Vitalik Buterin, proposed a set of measures to protect the decentralisation of the blockchain behind the second-largest cryptocurrency.

He described three priorities to help prevent centralisation and keep Ethereum open even if block creation ends up controlled by large players. They include:

- strengthening the public mempool;

- developing distributed, out-of-protocol block-building technologies;

- adding additional channels for transaction inclusion.

One such channel is the FOCIL mechanism, designed to prevent censorship of transactions. It envisages selecting 17 validators for each slot, one of whom would determine the final order of operations in a block.

The prospect of implementation raised concerns among part of the community.

TRON to cut on-chain fees by 60%

On August 29th, voting closed on a proposal to cut TRON network fees by 60%. A majority of participants approved the initiative.

Founder Justin Sun acknowledged that, in the short term, this will negatively affect the blockchain’s revenues.

The plan is to offset the drop in income by attracting more users and increasing transactions, encouraged by lower fees.

The TRON community now intends to review fee levels quarterly.

Also on ForkLog:

- Tether will launch USDT on the Bitcoin network.

- OpenAI will enhance ChatGPT security after a teenager’s tragedy.

- El Salvador shielded its 6,284 BTC from a quantum threat.

- AI as God: a musician founded a new religious movement.

MetaMask adds sign-in via Google and Apple ID

Developers of the MetaMask crypto wallet integrated a “social login” using Google and Apple ID services.

The feature lets users register or sign in to a wallet created this way. After setting a password, a seed phrase is generated automatically and can be recovered using Web2 accounts.

The move aims to simplify digital-asset management while preserving a high level of security.

What else to read?

We explained in a new piece how AML systems at crypto trading platforms work.

In our weekly digest, we compiled the key cybersecurity events.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!