The implied volatility of the leading cryptocurrency has fallen to its lowest level since 2023, according to analysts at XWIN Research.

Bitcoin’s Calm Before the Storm

“These three signals paint a consistent picture: exchange supply is drying up, investors are sitting tight, and derivatives markets are calm. While implied volatility points to one of the quietest phases in years.” – By @xwinfinance pic.twitter.com/e5aGBbcpb0

— CryptoQuant.com (@cryptoquant_com) September 24, 2025

Previously, such a situation preceded a price increase from $29,000 to historical highs. Blockchain data suggests a “calm before the storm,” experts believe.

Three Key Signals

Bitcoin reserves on exchanges continue to decline and are near multi-year lows. This indicates a decrease in the number of coins available for immediate sale. Historically, a drop in reserves has led to a supply shortage amid a sharp increase in demand, specialists noted.

The MVRV ratio is in a neutral zone around 2.1. XWIN Research pointed out that investors lack a strong incentive for panic selling or mass profit-taking.

Funding rates on major exchanges remain moderate. This shows that traders in the derivatives market are not opening long or short positions with high leverage.

Potential Pressure

CryptoQuant analyst Julio Moreno noted a brief surge in the inflow of bitcoins to trading platforms, reaching 5,000 BTC per hour.

Bitcoin flowing into exchanges has grown in the last few hours, and reached a hourly high of 5K. pic.twitter.com/RguZW2ZYZZ

— Julio Moreno (@jjcmoreno) September 23, 2025

His colleague Axel Adler Jr. believes that the market structure has shifted in favor of the bears.

The market structure has shifted, with the composite index falling below the −0.4 threshold, indicating bear dominance, a negative fast–slow EMA spread accounting for the trend and price positioning in the lower part of the 21-day Donchian Channel.

The market has transitioned… pic.twitter.com/NnS1Xkw5NE

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 24, 2025

In his view, the current price rebounds are merely “corrective rallies,” not the start of a new trend.

According to Glassnode, inflows into US spot bitcoin-ETFs have slowed after a strong start in September, with recent sessions showing a slight outflow of funds. This may indicate a pause in institutional demand.

Analysts also noted that long-term holders have already realized a historically large volume of profits — 3.4 million BTC since reaching a new cycle high.

What About Ethereum?

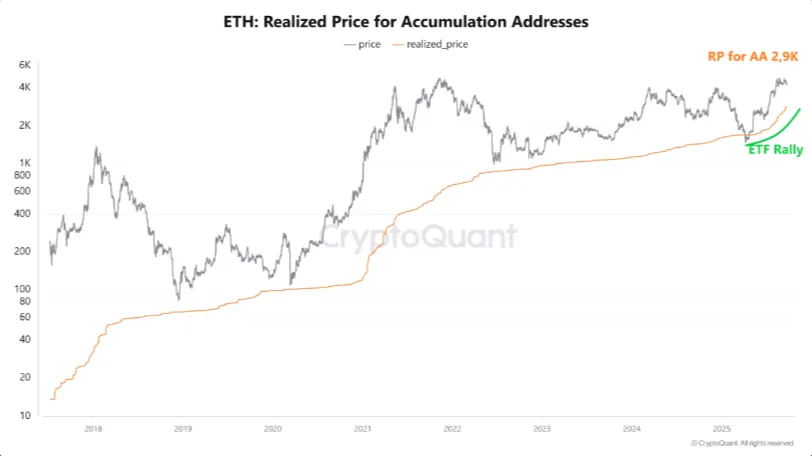

In the Ethereum market, the key support zone could be the $2,900 level. According to CryptoQuant analyst Burak Kesmeci, this is the average purchase price of the second-largest cryptocurrency by market capitalization for “accumulation addresses.”

The total balance on such wallets has reached 27.6 million ETH. In the event of a strong correction, the level mentioned by the expert could provide significant support to the price.

Additional tension in the Ethereum market is created by the upcoming expiration of options worth $5.5 billion. The “maximum pain” point for this event is at $3,700 — the level at which holders will incur the greatest losses.

The put-to-call ratio is 0.76, indicating moderately bearish sentiment. The large volume suggests high trader interest and expectations of increased volatility near the expiration date.

On September 23, analyst Mr. Anderson also noted that the volatility of digital gold had reached a historic low.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!