Between 6 and 12 October, Strategy bought 220 BTC for $27.2m. The company’s assets under management reached 640,250 BTC worth about $73bn.

Strategy has acquired 220 BTC for ~$27.2 million at ~$123,561 per bitcoin and has achieved BTC Yield of 25.9% YTD 2025. As of 10/12/2025, we hodl 640,250 $BTC acquired for ~$47.38 billion at ~$74,000 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/Ft9ZCh1EGx

— Strategy (@Strategy) October 13, 2025

The average purchase price was $123,561 per coin. Since the start of 2025, the bitcoin on the firm’s books has returned 29.5%.

Strategy raised funds by issuing preferred shares STRK, STRF and STRD under an expanded $84bn capitalisation programme running through 2027.

Michael Saylor’s company remains the largest corporate holder of digital gold. A day before the tranche, the firm’s head shared a post alluding to the market correction sparked by new trade tariffs from US president Donald Trump.

Don’t Stop ₿elievin’ pic.twitter.com/LUMroqLSCl

— Michael Saylor (@saylor) October 12, 2025

“Don’t stop believing,” he wrote.

At the time of writing, 188 companies worldwide had joined the strategy of accumulating bitcoin. They manage 4.6% of the asset’s total supply.

A week earlier — from 29 September to 5 October — Strategy did not purchase the leading cryptocurrency, as it failed to raise capital via a share sale. The pause coincided with bitcoin setting a new all-time high above $125,000.

After a drop below $111,000, the price of digital gold recovered to $114,400.

BitMine and Ethereum

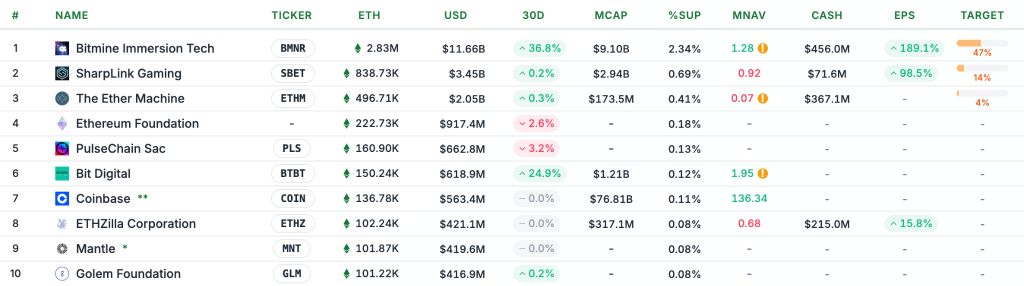

On 13 October, BitMine Immersion Technologies reported another round of Ethereum purchases. The firm acquired 202,037 ETH at a discount, taking advantage of the downturn across digital assets, according to a press release.

At the time of writing, the cryptocurrency was trading around $4,107. Earlier, its price fell to $3,700.

Onchain Lens experts flagged BitMine’s transactions on 11 October.

One more newly created wallet withdrew 27,159 $ETH, worth $104.19M, from #Kraken.

In total, 3 wallets withdrew 78,824 $ETH, worth $302.12M from #Kraken, likely belonging to #BitMine.

Address: 0x2fde430b28f49a9ff87a555376b9c1c28dd60b4c https://t.co/tCbL3ojCYa pic.twitter.com/m2cM2y2RGm

— Onchain Lens (@OnchainLens) October 11, 2025

The company’s reserves reached 3.03m ETH, equal to 2.5% of the second-largest cryptocurrency’s supply. It plans to accumulate 5% of the altcoin’s supply.

BitMine’s portfolio also includes 192 BTC, a $135m stake in Eightco Holdings and $104m in cash.

BNB

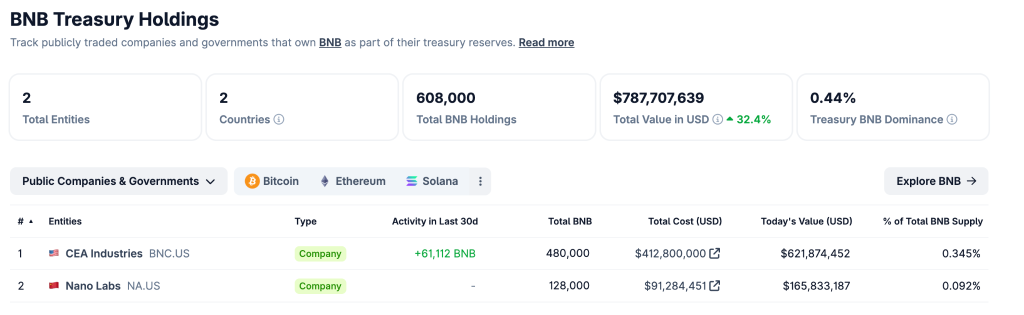

Hong Kong’s China Renaissance Holdings is in talks to raise $600m for a fund focused on accumulating BNB, Bloomberg reported.

Shares in the new vehicle are planned to be listed on an American exchange. Venture fund YZi Labs will participate in the deal. The firms are expected to invest $200m jointly.

In late August, China Renaissance said it would invest $100m in BNB as part of its collaboration with YZi Labs. The press release said the company became the first in Hong Kong to include the Binance-linked cryptocurrency in its reserves.

Two of the company’s firms now accumulate BNB — CEA Industries and Nano Labs. They manage 608,000 coins worth about $787m.

Earlier, CEA Industries head David Namdar called BNB an undervalued asset. On 13 October, the cryptocurrency set a record high of $1,370.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!