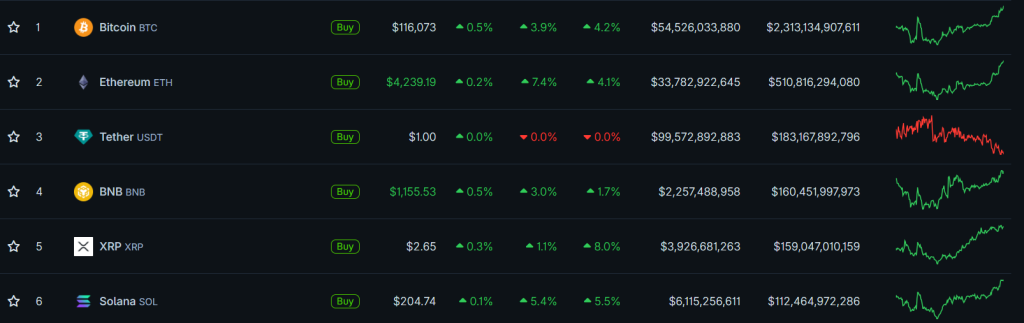

The price of the leading cryptocurrency rose nearly 4% over the past 24 hours, hitting a two‑week high around $116,000.

Ether rose 7% over the same period, to about $4,200.

Other large altcoins advanced: XRP added 1.1%, BNB 3%, and Solana 5.4%.

Macro factors lent support. US Treasury Secretary Scott Bessent spoke of “substantial” progress in trade talks with China.

.@SecScottBessent on China: “President Trump gave me a great deal of negotiating leverage with the threat of 100% tariffs on November 1st — and I believe we’ve reached a very substantial framework that will avoid that and allow us to discuss many other things with the Chinese.” pic.twitter.com/mUz1k9kZpu

— Rapid Response 47 (@RapidResponse47) October 26, 2025

He said the proposed framework would avert the 100% tariffs previously announced by President Donald Trump.

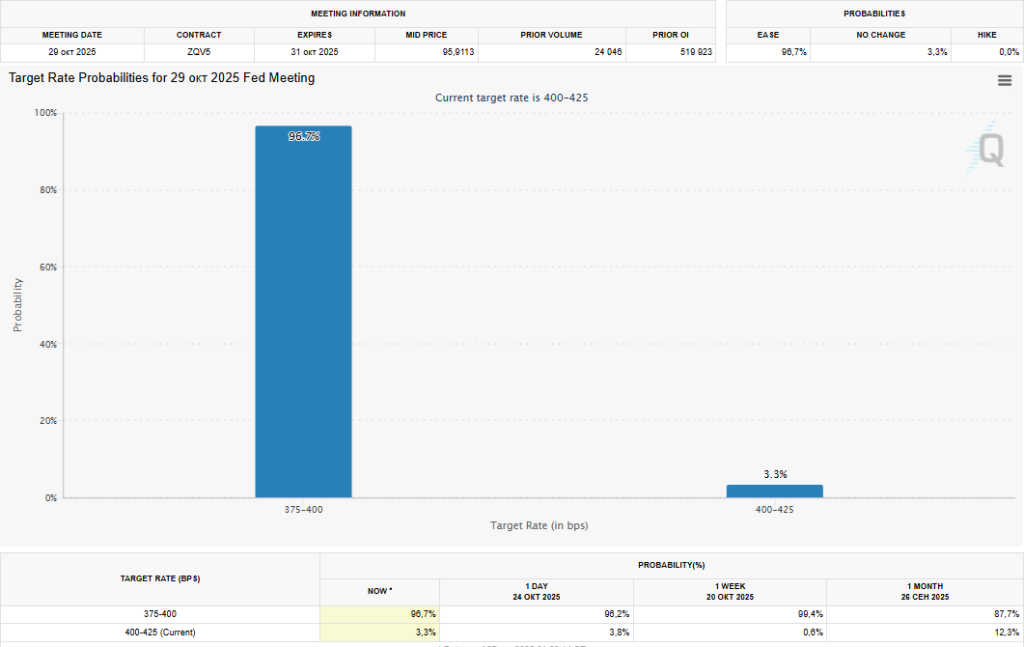

Further optimism stems from the upcoming FOMC meeting. Markets expect a 25‑basis‑point cut to a 3.75–4% range. The CME FedWatch tool puts the probability at 96.7%.

Short‑position liquidations

Against the upbeat backdrop, the market saw a wave of short liquidations. Over the past day, $393.62 million of shorts were forcibly closed, according to Coinglass.

“This is a classic short squeeze. It may signal the start of a more sustained bullish phase,” — said BTC Markets analyst Rachel Lucas.

Earlier, CryptoQuant contributors from ShayanMarkets said that the MVRV ratio on the leading cryptocurrency’s chart had fallen below the 365‑day simple moving average, marking a local low.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!