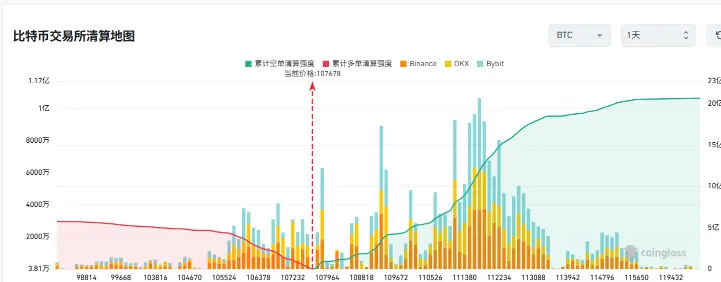

According to Coinglass data, if Bitcoin falls below $107,000, the cumulative long liquidation intensity on major CEXs will reach $259 million. Conversely, if Bitcoin breaks above $109,000, the cumulative short liquidation intensity on major CEXs will reach $128 million.

Note: The liquidation chart does not display the exact number of contracts pending liquidation or the exact value of contracts being liquidated. The bars on the liquidation chart actually represent the significance of each liquidation cluster relative to nearby liquidation clusters, i.e., intensity. Therefore, the liquidation chart shows to what extent the underlying price reaching a certain level will be affected. A higher “liquidation bar” indicates that once the price reaches that point, there will be a stronger reaction due to liquidity waves.

ChainCatcher reminds readers to view blockchain rationally, enhance risk awareness, and be cautious of various virtual token issuances and speculations. All content on this site is solely market information or related party opinions, and does not constitute any form of investment advice. If you find sensitive information in the content, please click “Report”, and we will handle it promptly.