Analyst warns of bear phase; bitcoin could fall to $74,000.

The crypto market has edged toward a bear phase by three key metrics for institutional investors. Analyst Axel Adler Jr. allowed for bitcoin dropping to $74,000.

The most critical question that will concern all investors right now: how deep will the market correction go in this bear phase?

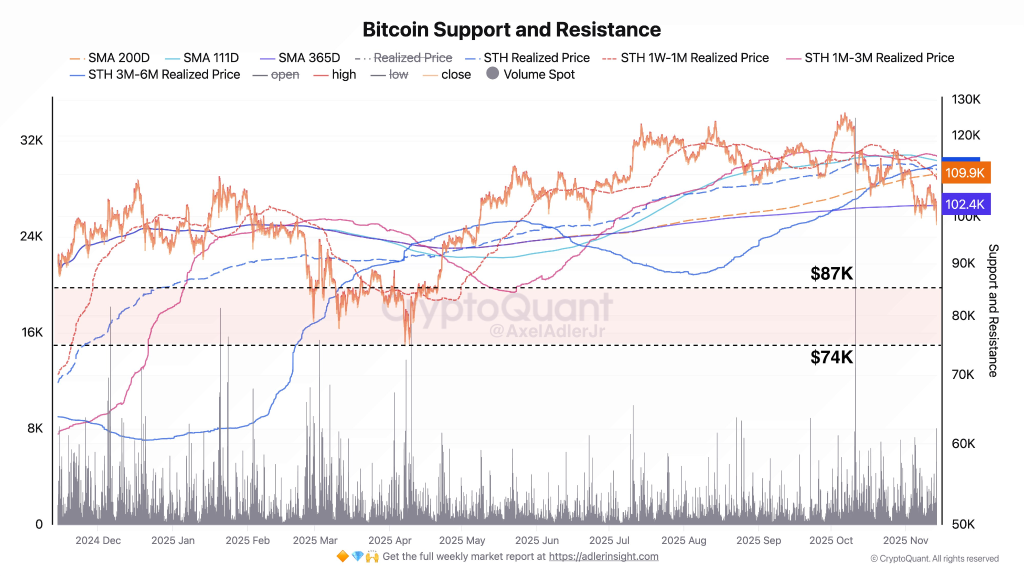

I’ve identified two critical levels:

Level 1 = $87K

Level 2 = $74KWhy specifically $87K was discussed last week when I covered the conservative… pic.twitter.com/tsKplZdPGe

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) November 14, 2025

“The main question worrying all investors at this stage is how deep the correction will be. Based on my analysis, I have identified two critical levels: $87,000 and $74,000,” he said.

He stressed that key indicators that previously acted as support have now turned into resistance.

Adler Jr. said the current price of digital gold is almost 12% below the 200-day moving average—$110,486. By BlackRock and Goldman Sachs standards, that signals a bear trend.

An additional signal is a series of lower local highs and lows on the daily chart since 13 November.

Of particular concern is an imminent moving-average crossover—the “death cross.” The spread between the SMA50 ($110,972) and SMA200 ($110,486) has narrowed to $486 (0.44%) and could close in the coming days. That would activate the third bearish metric in institutional models.

“Formally, the market phase is still classified as bullish (the price is 20% above the yearly low of $76,276), but two of the three indicators have already flipped bearish, and the third is on the brink of changing signal. If a ‘death cross’ forms, institutional trading models will unanimously switch to recognizing a bearish trend,” Adler Jr. wrote.

At the time of writing, bitcoin is trading around ~$96,300, down 6.3% over the past 24 hours.

CryptoQuant CEO Ki Young Ju noted that a bear trend is still unconfirmed. He pointed to a cohort of investors who bought digital gold six to 12 months ago. Their average entry price is $94,000.

Those who entered Bitcoin 6 to 12 months ago have a cost basis near 94K.

Personally, I do not think the bear cycle is confirmed unless we lose that level. I would rather wait than jump to conclusions. pic.twitter.com/i9a5M0xnMW

— Ki Young Ju (@ki_young_ju) November 14, 2025

“Personally, I do not think the bear cycle is confirmed unless we lose that level. I would rather wait than jump to conclusions,” he said.

Why is bitcoin falling, and what would it take to recover?

The correction in the leading cryptocurrency is tied to pressure from US investors, tax-driven selling by long-term holders and reduced liquidity due to the US government shutdown. That is the view of analysts at XWIN Research Japan.

Bitcoin’s Decline Driven by U.S. Liquidity Stress, LTH Tax-Driven Profit Taking, and Persistent American Selling

“Together, these factors form a clear narrative: the current correction is driven primarily by the United States.” – By @xwinfinance pic.twitter.com/mIPbwqgM4r

— CryptoQuant.com (@cryptoquant_com) November 14, 2025

They said the Coinbase premium has been “deeply negative for weeks,” pointing to aggressive selling on the American exchange compared with platforms in Asia and Europe. The pattern is recurring: bitcoin recovers during the Asian session but loses ground after US markets open.

At the same time, long-term holders across all age bands—from six months to seven years—are locking in profits. Such synchrony is rare and is presumably tied to US investors’ tax optimisation.

Fidelity has confirmed that many clients are closing positions to crystallise tax liabilities, the experts noted.

The halt in US government operations exacerbated the situation, creating a fiscal deficit and draining billions of dollars from the financial system. Against the backdrop of fading expectations of a December rate cut by the the Fed, this has dampened risk appetite.

“As liquidity returns over the coming weeks, market conditions may stabilise, but near-term pressure continues to be defined primarily by US market dynamics,” XWIN Research Japan concluded.

Analysts at Swissblock also flagged the importance of a liquidity rebound. In their view, the end of the shutdown has already opened the way for its return and for risk appetite to rebuild across markets.

With the U.S. government shutdown resolved, macro uncertainty is easing, paving the way for liquidity to return and risk appetite to rebuild across markets.

Bitcoin now shows its most negative correlation with U.S. indices this year, an extreme decoupling.

Bitcoin starts to… pic.twitter.com/qMioZB7lFx

— Swissblock (@swissblock__) November 13, 2025

Glassnode co-founder under the pseudonym Negentropic recalled that after the US government resumed work in 2019, bitcoin hit a “bottom” and recovered over the following 12 days.

Resolving the crisis would release at least $150bn of excess liquidity, providing substantial support for markets.

Swissblock believes the crypto sector is now in the final stage of forming a local bottom. They stressed that “this will take quite some time.”

A similar view was earlier expressed by specialists at Wintermute and Glassnode.

“The current situation resembles the period from late August to early September: tensions are rising, but there are no structural disruptions. Spot demand remains resilient, as it has since mid-October. Volatility is high, but the trend remains intact. The more stable the level of risk, the faster a bottom will form,” Swissblock noted.

They said that, for now, everything depends on digital gold’s ability to close the week above the $97,000–98,500 zone.

Earlier, amid the correction, spot bitcoin ETFs recorded the second-largest outflow on record, at $870m.

QCP Capital analysts cited factors supporting the leading cryptocurrency into year-end, including a possible Fed rate cut and resilient corporate earnings.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!