By Liam Mo and Brenda Goh

BEIJING (Reuters) -China’s Alibaba (BABA) is likely to highlight its artificial intelligence strategy with its quarterly results on Friday, but in line with its peers Tencent and Baidu, may struggle to show that its big AI investments are paying off.

The companies have invested billions of dollars into AI over the past three years following the global success of ChatGPT, hailing it as a key revenue driver.

They rolled out their own large language models and infused them into their flagship products. But making money from these efforts has proved difficult so far, as Chinese users, unlike Western customers, have demonstrated strong resistance to paid subscription models, analysts said.

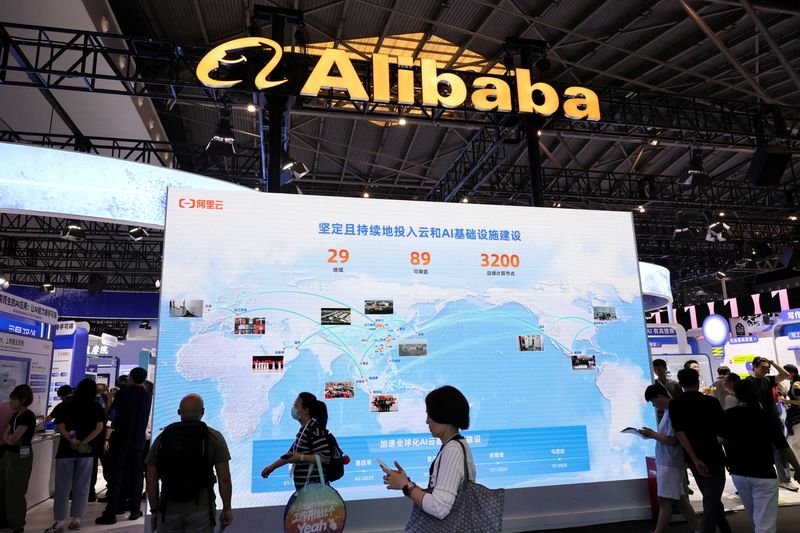

Alibaba has been among the most aggressive in China’s AI industry, showcasing advancements on an almost weekly basis.

The weak contribution from the AI push dampens Alibaba’s growth outlook at a time when its core e-commerce business is locked in an intense price competition with rivals to keep consumers spending amid persistent economic weakness in China.

Analysts estimate revenue from its cloud business which includes AI-related product sales grew just 4.3% in the April-June quarter from the previous quarter to 31.4 billion yuan ($4.4 billion), according to LSEG data. That would be up 18% from a year earlier, but suggests growth is slowing.

Tencent’s earnings showed this month that revenue from the business that includes selling AI services is growing more slowly than its core gaming business. Baidu’s did not expand fast enough to offset declines in its advertising revenue.

When it first launched its Ernie chatbot in late 2023, Baidu attempted a subscription model with a 59.9 yuan monthly fee. But it discontinued the paid service in April after poor take-up by users.

“In China, in reality, it’s actually very hard to use the user-paid model, which now populates the U.S. AI tools,” Tencent President Martin Lau said during the company’s earnings call this month.

Baidu CEO Robin Li said this week the company would take a “prudent approach” to AI monetisation, while prioritising user experience.

SHIFT TO ENTERPRISE CUSTOMERS

With consumer subscriptions proving unviable, Chinese AI developers have pivoted to enterprise customers with application programming interface (API) services provided through their cloud platforms.

“The consumer market is a challenge for AI developers in China. The more realistic path will be in the enterprise market,” said Lian Jye Su, chief analyst at technology research firm Omdia.