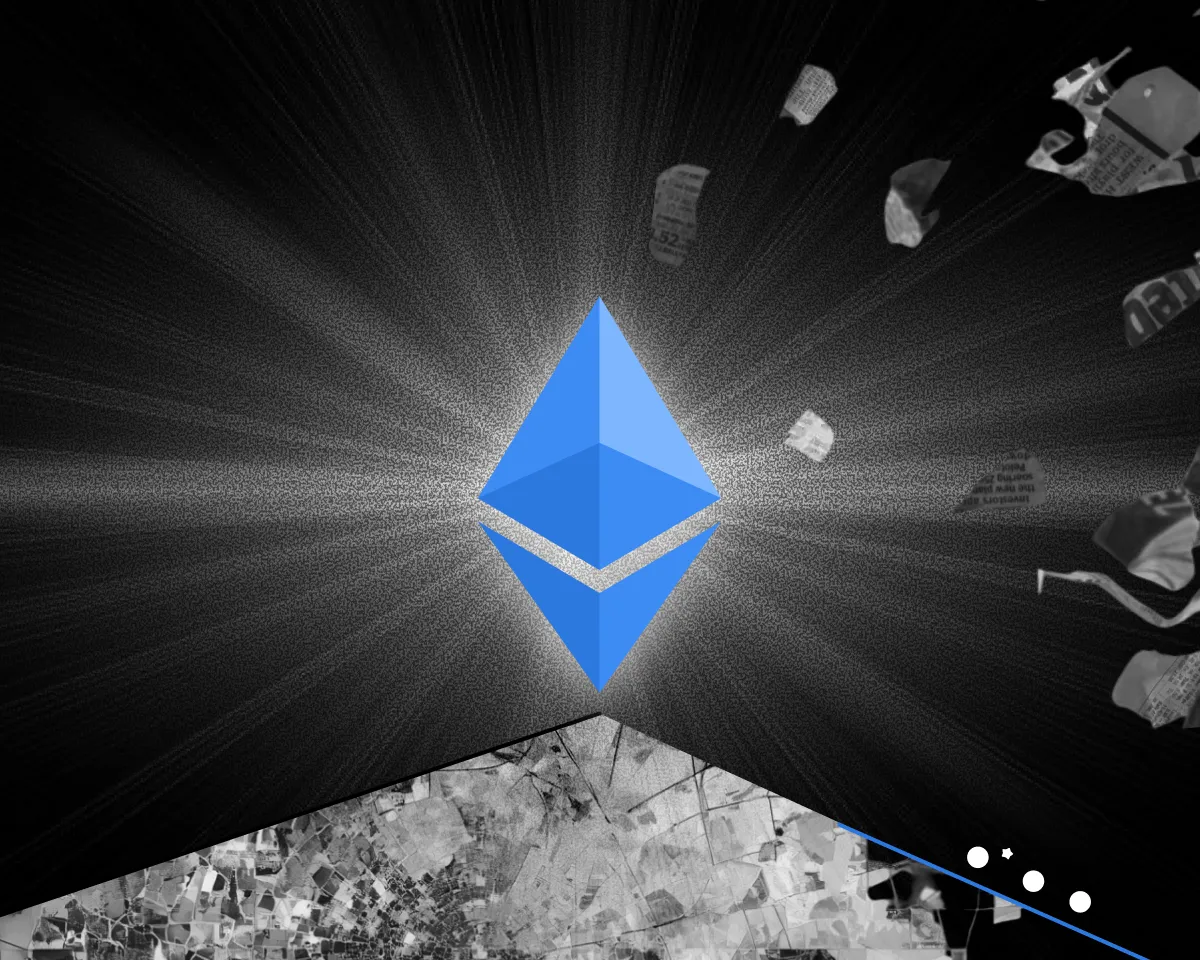

The second-largest cryptocurrency by market capitalization continues to outpace digital gold and major altcoins in growth rates. Nick Rak, Director of LVRG Research, identified three key factors that give Ethereum an advantage over Bitcoin, reports The Block.

In the past 24 hours, the price of Ether has risen by 1.2%, while the flagship cryptocurrency has decreased by 0.3%.

According to Rak, Ethereum leads due to record inflows into spot ETFs, a reduction in supply driven by the growing popularity of staking, and demand from corporate treasuries.

In August, ETH-based exchange-traded funds attracted $3.8 billion, while Bitcoin-focused instruments lost $751 million. Meanwhile, the number of staked tokens exceeded 35.7 million, amounting to $162 billion—31% of the total cryptocurrency supply.

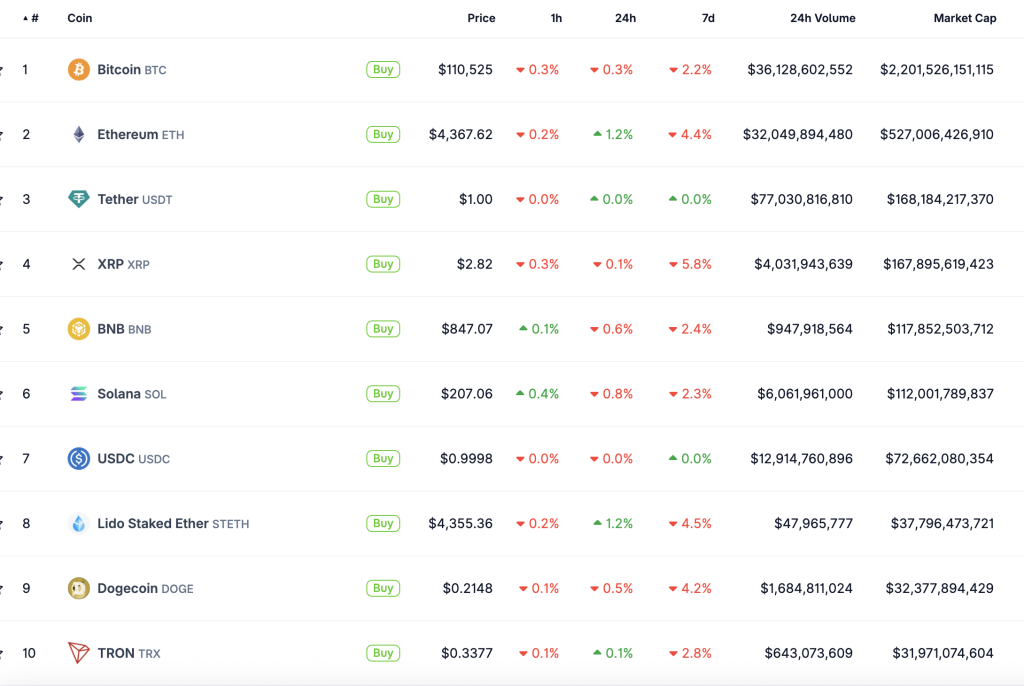

Presto Research analyst Min Jung confirmed that buying pressure is supported by the activity of public companies acquiring Ethereum.

“ETH is once again outperforming the market, likely due to fund inflows driven by DAT. However, we remain cautious about the sustainability of this trend and the ability of firms to maintain elevated purchase volumes in the long term,” she noted.

Previously, the trend towards creating DAT sparked debates among market participants. Proponents argue that such structures “enhance ecosystem visibility” and create long-term value. Critics point to the risks of conflicts of interest.

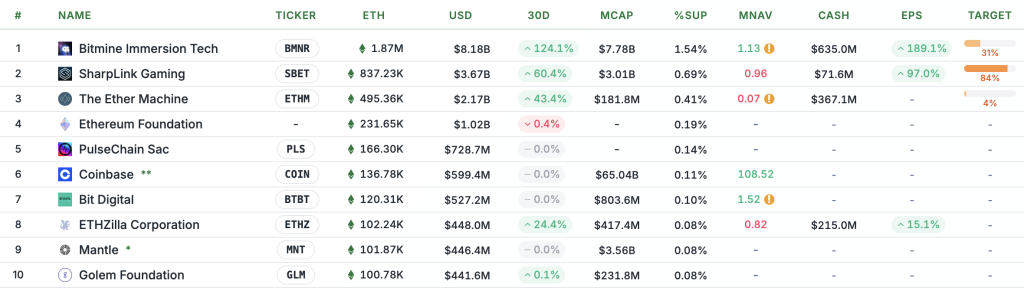

At the time of writing, the four largest holders of Ethereum among public companies—Bitmine, SharpLink Gaming, Bit Digital, and BTCS—hold approximately 2.7 million ETH valued at $12 billion.

In early September, an expert warned of risks for public treasuries of the second-largest cryptocurrency. According to SharpLink co-founder Joseph Shalom, the pursuit of yield from holding Ethereum poses significant risks for companies.

In August, analysts at JPMorgan identified four factors that give the asset an edge over digital gold.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!