The crypto‑market correction triggered a sweeping purge of leveraged positions, creating conditions for a new leg higher in digital gold. Such a view was shared by CryptoQuant contributor EgyHash.

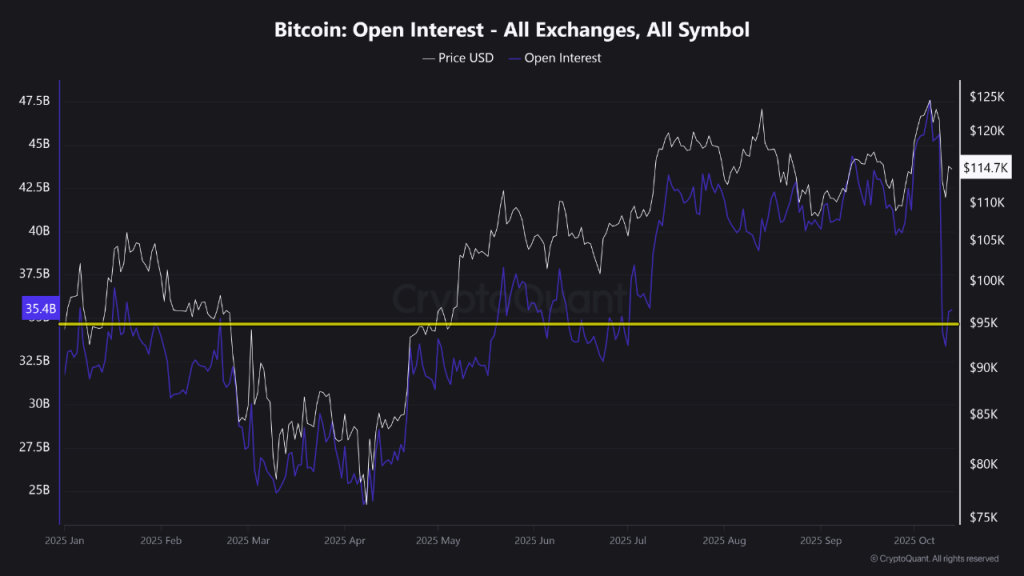

According to him, open interest in bitcoin futures plunged by $12bn — from $47bn to $35bn. He called it “one of the most significant reductions in recent years.”

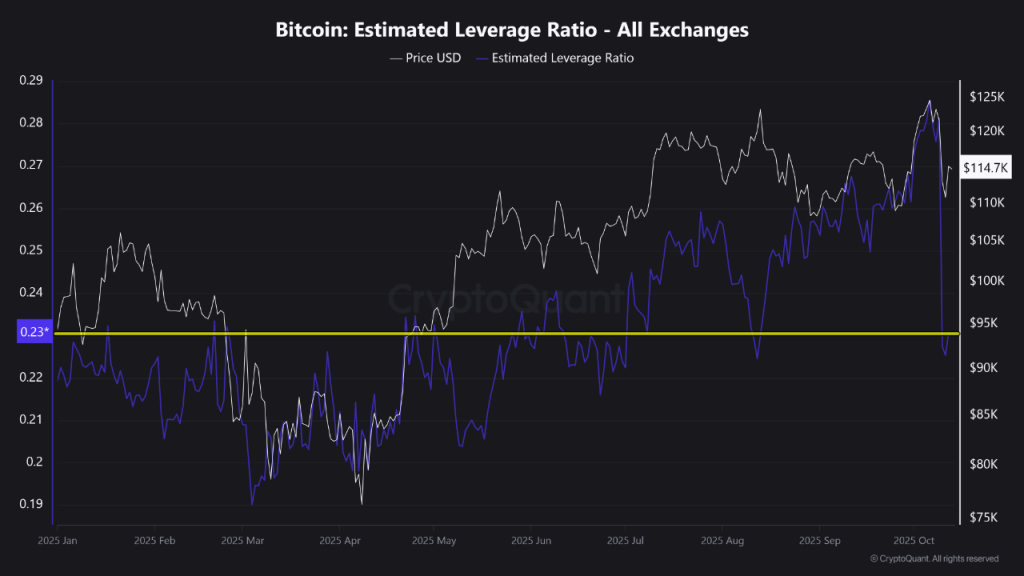

The estimated leverage ratio (ELR), which gauges traders’ average leverage relative to exchange reserves, fell to its lowest since 2022.

However, the ratio of stablecoins to bitcoin (SSR) plays a particular role, EgyHash noted. The reading has matched April lows.

“This trend indicates rising liquidity in ‘stable coins’ relative to the first cryptocurrency, which potentially points to an accumulation of purchasing power,” the expert explained.

He stressed that historically such reductions in borrowed positions have preceded significant long-term uptrends.

EgyHash’s conclusions are also supported by Glassnode’s analysis. The firm noted that the sweeping liquidation erased “excess” speculative bets, reducing the risk of similar crashes in future.

Friday’s wipeout triggered the largest futures liquidation in Bitcoin’s history. Over $11B in open interest was erased as leverage was forcefully unwound. A historic deleveraging event that has reset speculative excess across the market. pic.twitter.com/IzcEtGbCSE

— glassnode (@glassnode) October 13, 2025

Another bullish factor

According to Glassnode, funding rates across crypto derivatives have dropped to their lowest since the 2022 bear market.

Funding rates across the crypto market have plunged to their lowest levels since the depths of the 2022 bear market.

This marks one of the most severe leverage resets in crypto history, a clear sign of how aggressively speculative excess has been flushed from the system. pic.twitter.com/XBufZmA9vs

— glassnode (@glassnode) October 12, 2025

Negative readings indicate a dominance of short positions, as traders expect further declines. Yet extremely low rates often set the stage for a bullish scenario — if prices begin to rise, a short squeeze may force short-sellers to close positions en masse.

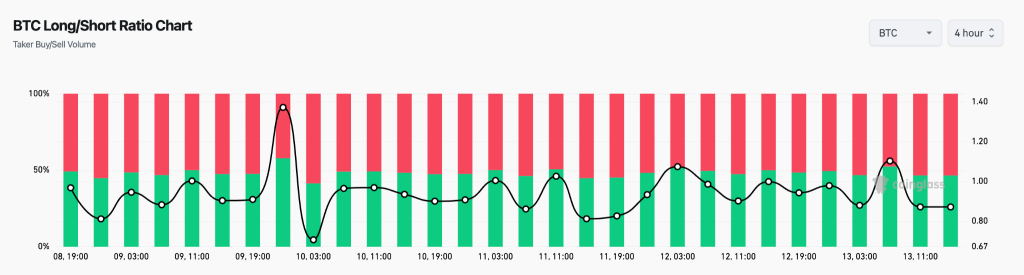

At the time of writing, the long-to-short ratio stands at 46.58% versus 53.42%.

Bitcoin’s funding rate on Binance remains in negative territory, signalling investor caution. Ethereum’s has turned positive.

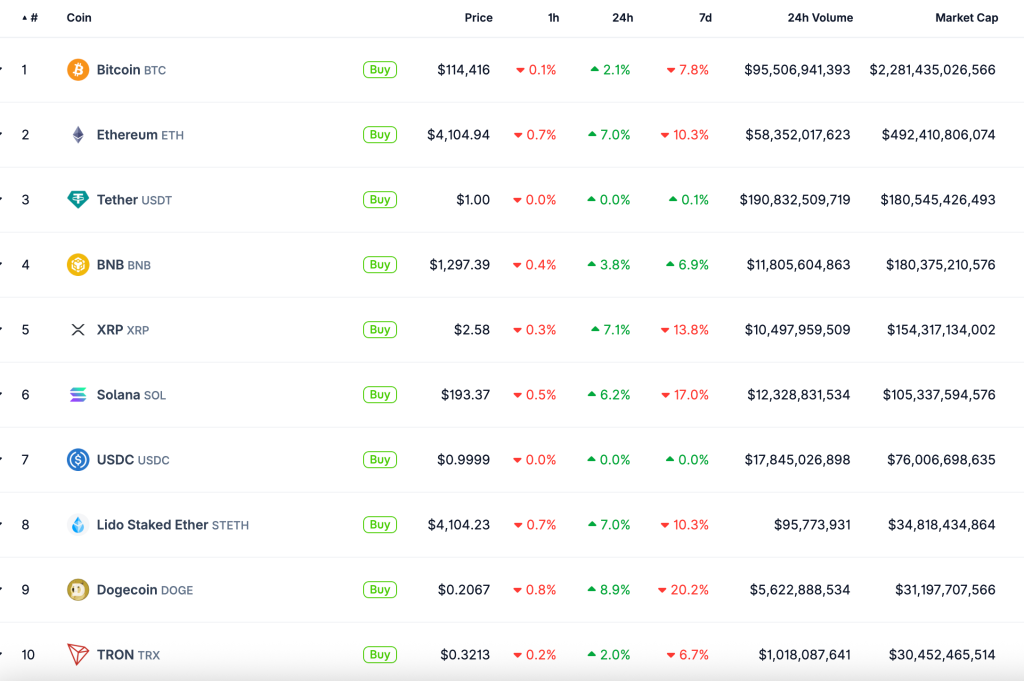

At the time of writing, the first cryptocurrency trades around $114,500, up 2.1% over the past 24 hours. The leading altcoin has recovered to $4,100.

Earlier, crypto funds saw inflows of $3.17bn amid the market pullback. Since the start of the year, cumulative inflows have reached $48.67bn.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!