Which of the two leading cryptocurrencies is more decentralised by autumn 2025? Web3 researcher Vladimir Menaskop shares his view with ForkLog readers.

From the author

I have worked with cryptocurrencies since 2012: among other things, I mined from 2012 to 2018, so BTC and ETH were among the first assets I dealt with in depth. I still do not favour one over the other. As a crypto-enthusiast, I consider that pointless: our portfolios should be as broadly diversified as possible, not concentrated in one thing — otherwise that, too, is a kind of centralisation.

Unfortunately, not everyone sees it this way. Even such well-known figures as Jack Dorsey keep preaching bitcoin maximalism. They grant the first cryptocurrency’s network an edge over ether on decentralisation, relying not on objective data but on conviction. That only confuses market participants, especially newcomers. So let us compare the Bitcoin and Ethereum networks — and BTC and ETH — from several angles.

I know Bitcoin’s architecture well and Ethereum’s very well, so I tried to compare what can be compared and sidestepped what cannot. Still, a high-level, broad comparison matters more to me than minute details, because the layers of decentralisation are inexhaustible and a thorough analysis would take hundreds of pages. In other words, I simplified in places. Keep that in mind.

Levels of decentralisation: a list

The list can be quite long, but here is a simple approach:

- B2B — the decentralisation of the network’s “builders”: miners, validators, and so on;

- B2C — the decentralisation on the client side of the network.

Let us start with the first.

Decentralising the network’s actors

PoW and PoS

The community has long debated which consensus is better. While I consider PoW the right answer, one cannot deny that PoS has evolved markedly over the past ten-plus years — especially in Ethereum.

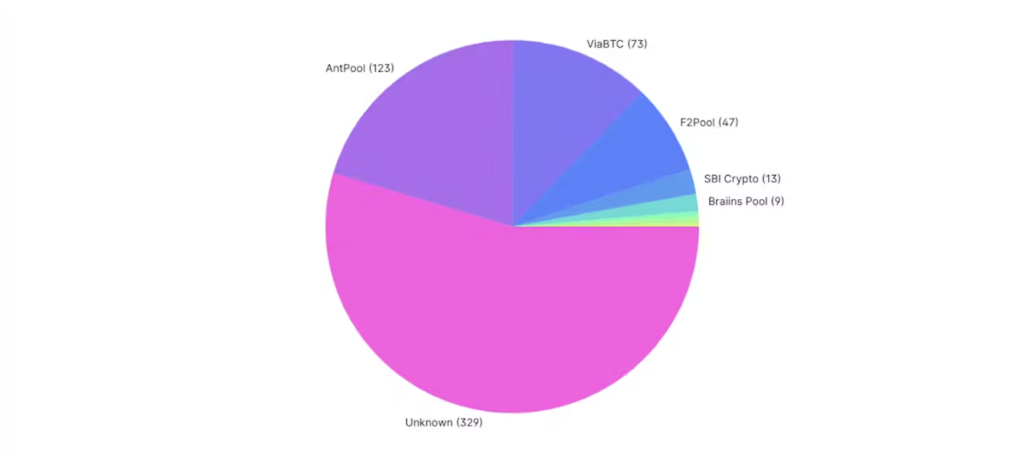

At one point, ether counted over one million validators (1,085,264), whereas Bitcoin has only about a hundred pools, two of which account for 40–51% of aggregate hashrate.

If you understand Bitcoin’s architecture, the point is obvious: there are no fewer miners than validators globally, and their entry threshold is lower (about $10,000 versus $100,000). But pooling distorts the optics. In any case, one cannot claim Bitcoin is more decentralised than ether here.

Nodes

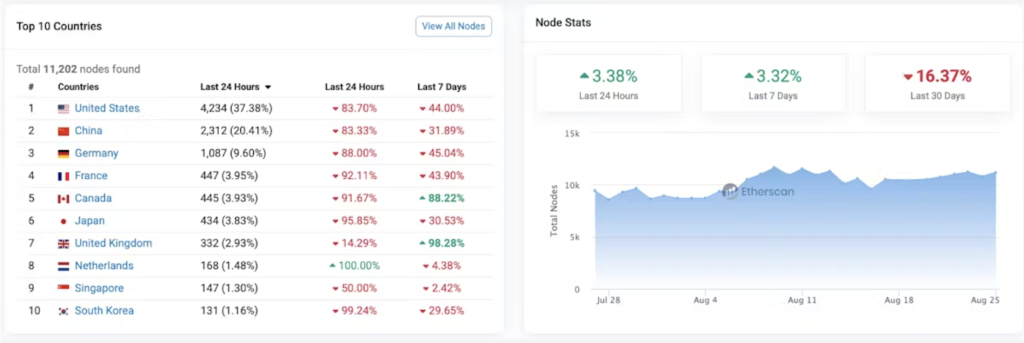

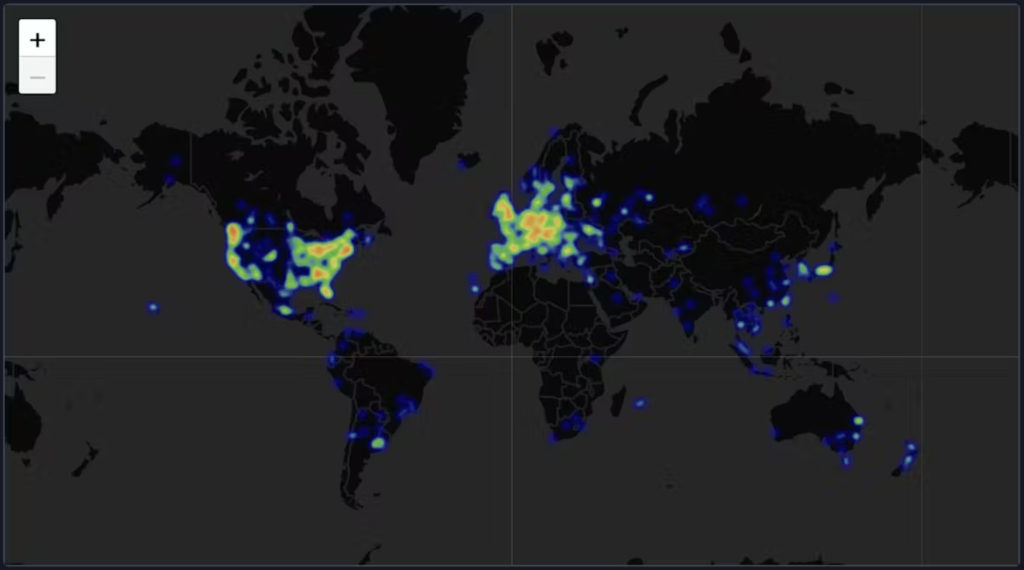

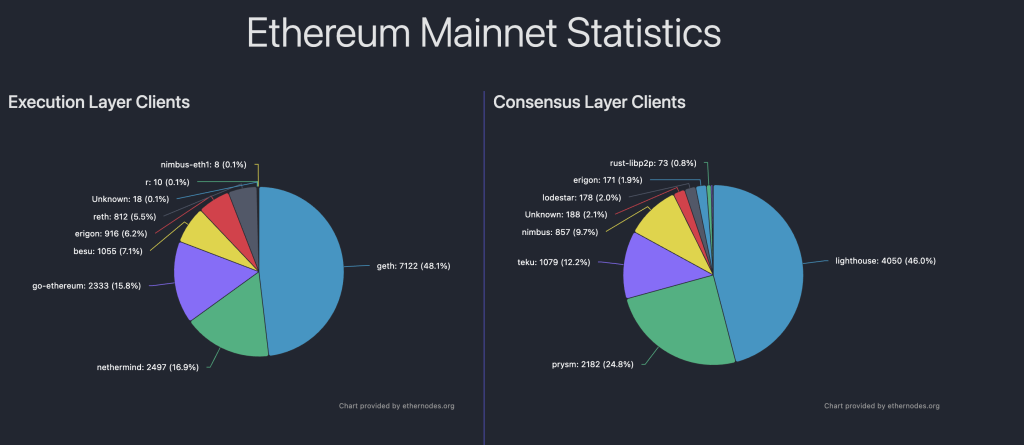

First, the geography. Here is ether:

And another view:

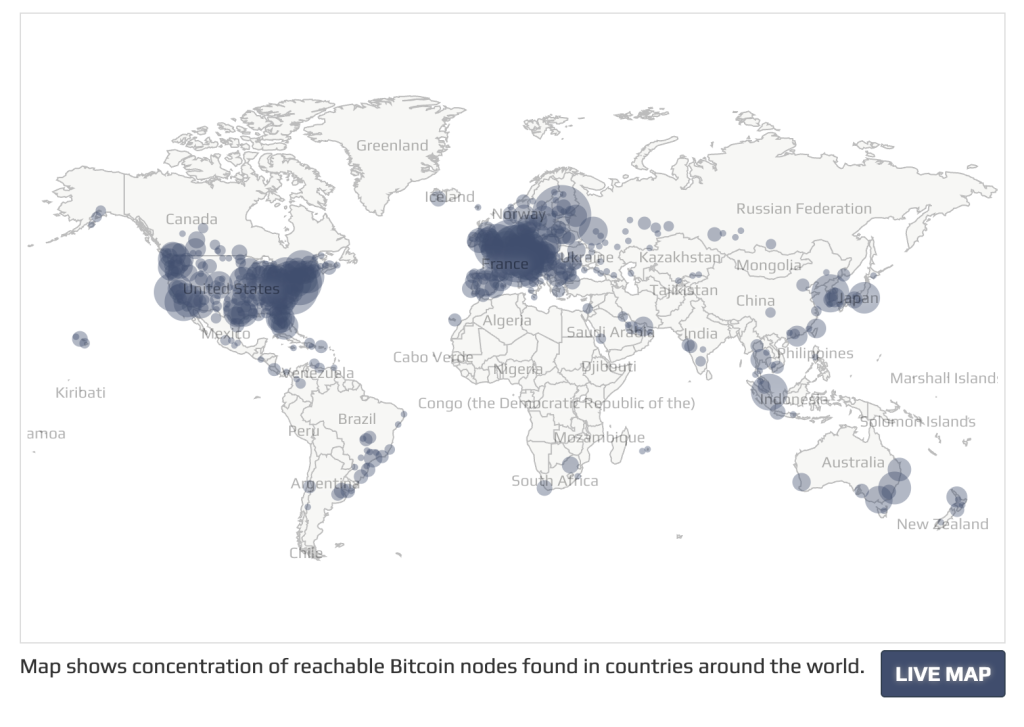

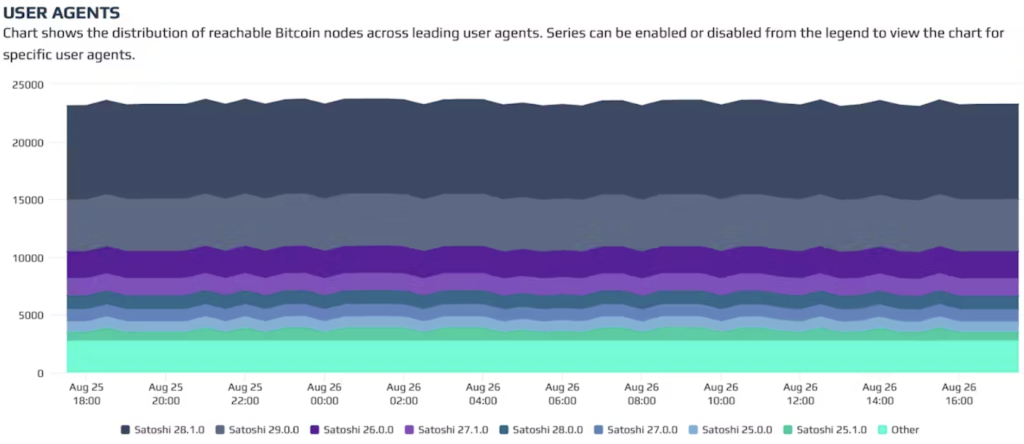

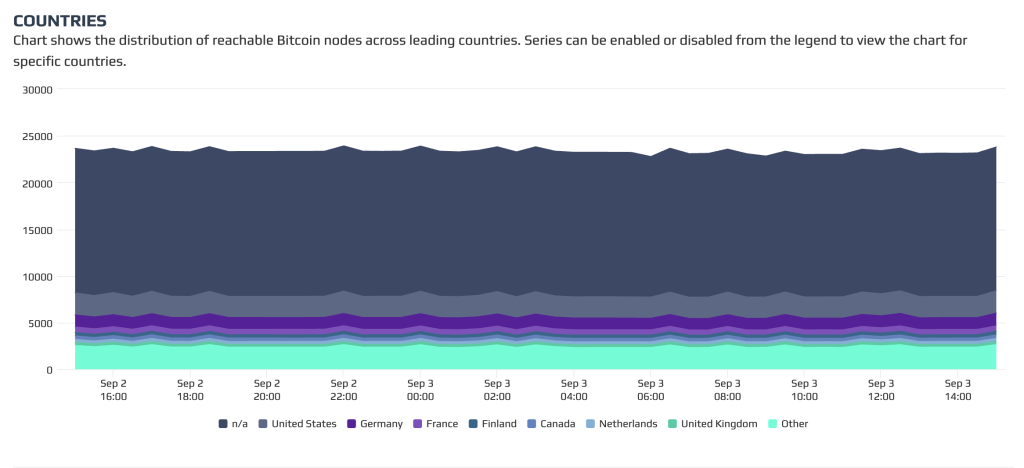

And here is Bitcoin:

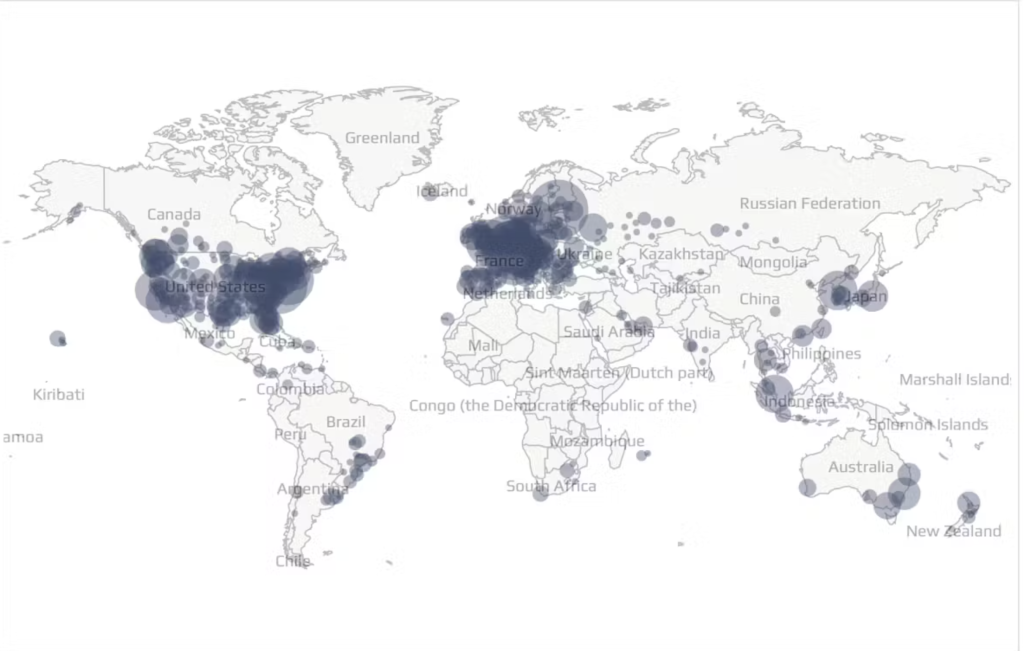

We get 23,244 Bitcoin nodes versus roughly 11,202 ether nodes — a difference of about twofold. Looking at the eight-year average, BTC is around 13,685, so there is no decisive advantage here either.

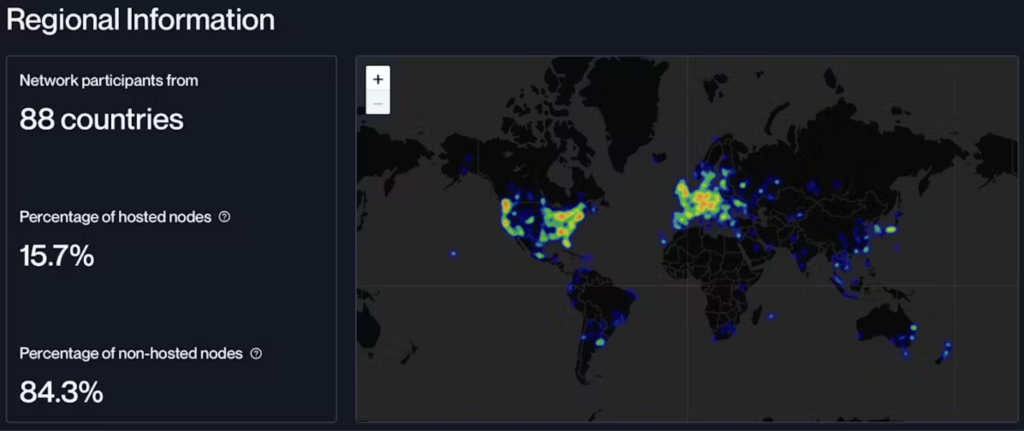

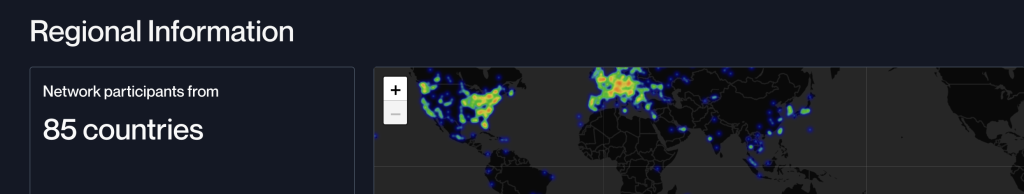

Moreover, both networks’ node heat maps are similar. Ether:

Bitcoin:

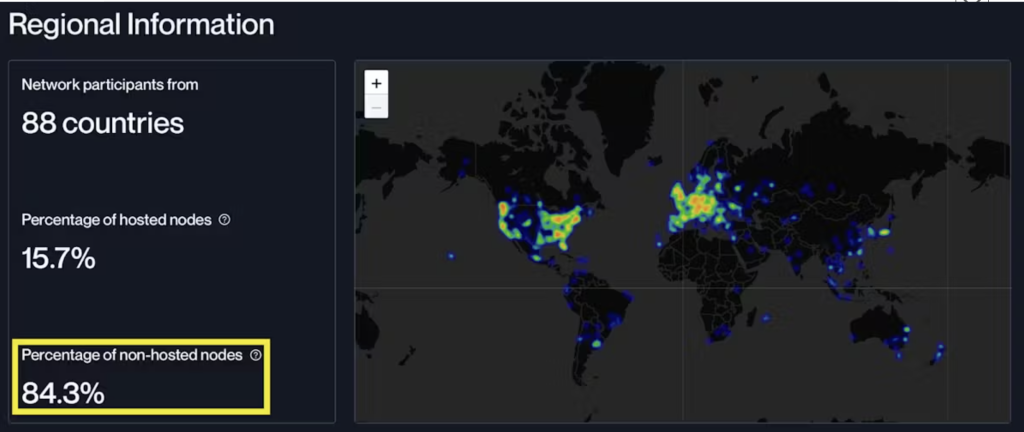

Ether depends on AWS and similar cloud solutions:

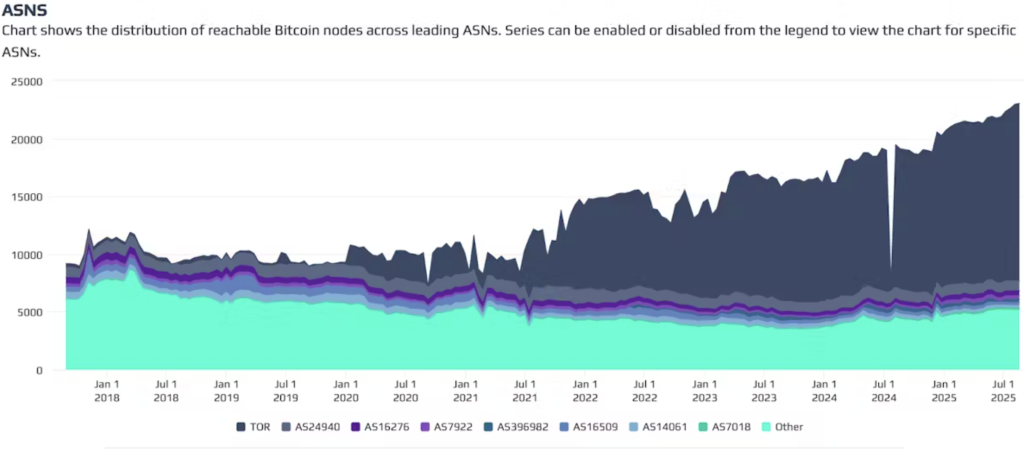

Some time ago I predicted the number of TOR nodes would grow on Bitcoin, and this metric (ASNS) is indeed impressive:

So Bitcoin leads here. But now look here:

And now — back to Bitcoin:

You may not wish to compare networks this way, but here ether clearly has the edge.

Before moving on, one note: Bitcoin mining is concentrated in the US, China, Russia (largely connected to Chinese pools), Canada and a number of other countries:

In Ethereum, even with AWS and formally American IPs for such nodes, you can still easily find 85 distinct locations:

Yes, one can connect to ever more pools, and they can be P2P, etc., but it is hard to argue that Bitcoin is unambiguously more decentralised geographically: if anything, the reverse.

And the full-node architectures of ether and the first cryptocurrency are quite different, so I will not compare them.

Note that Bitcoin node operators earn nothing. Miners do — for finding the nonce. In Ethereum, beyond validators there are block builders, relayers and searchers:

- validators — formally responsible for block selection and finality (proposing a block or signing attestations). Each slot assigns one proposer-validator;

- block builders — distinct participants who construct the blocks. They pick transactions from the mempool, order them, insert MEV transactions and optimise yields. Through the MEV-Boost protocol, builders pass finished blocks to the proposer-validator;

- relayers — intermediaries between builders and validators. They check block validity, hold it until publication, and guarantee payment to the validator;

- searchers — algorithmic traders/arbitrageurs who generate individual transactions for MEV. They do not build the whole block; they look for profitable insertions which they then pass to builders.

It is hard to claim the first of these roles is more decentralised than the fourth. And after mempool encryption and the introduction of ZKP mechanics, which Ethereum recently announced, the lead will certainly not lie with Bitcoin.

Development

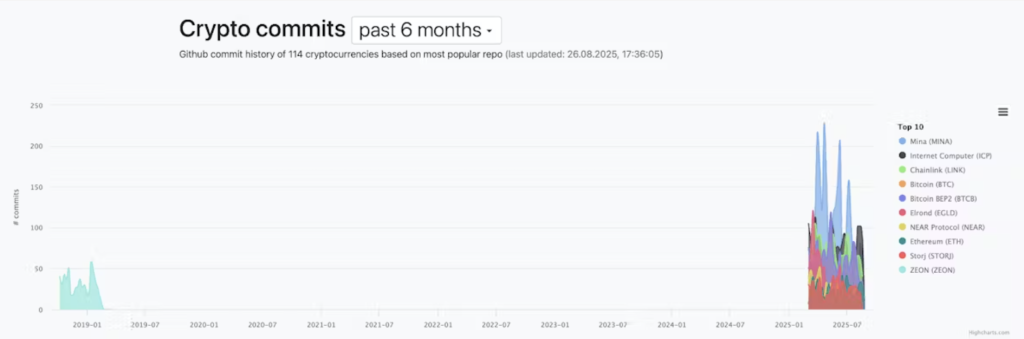

The “digital gold” network comes nowhere close to Ethereum in building dapps. Here is Bitcoin:

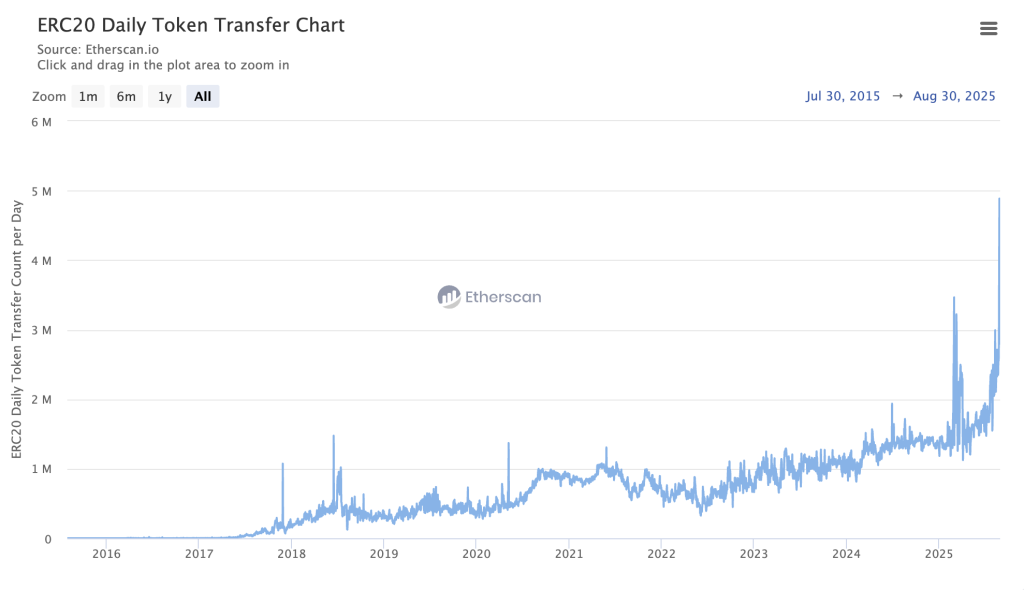

Ether, if it trails, does so only in certain vectors. Consider, say, ERC-20. Not all of this is dapps, but we are after a basic, not granular, comparison:

Each ERC-20 token is a project, an initiative or a new trend, and so on.

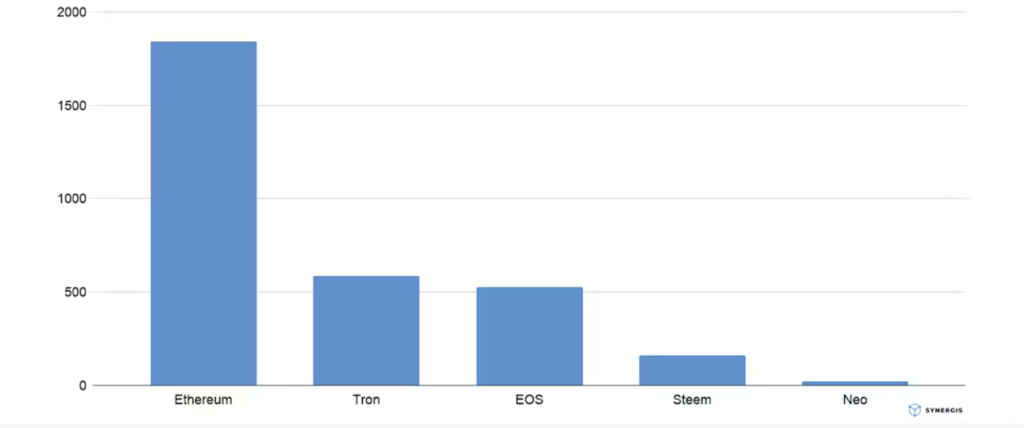

Compare the application ecosystems:

Leaders tend to follow Ethereum. In NFTs that is Blur and OpenSea, squeezed by Magic Eden — but only by copying their playbooks. In DeFi it is Aave and Uniswap, with Solana apps at best competing — again by copying. DePIN has now moved to Solana, but started on Ethereum.

It has always been so. Here is a snapshot from my earlier research on dapp counts:

L2 as the next step

Yes, in the first cryptocurrency’s network DeFi emerged back in 2014, but it went mainstream only in 2017–2020 thanks to Ethereum (even memes arose outside ether, but ether gave them momentum).

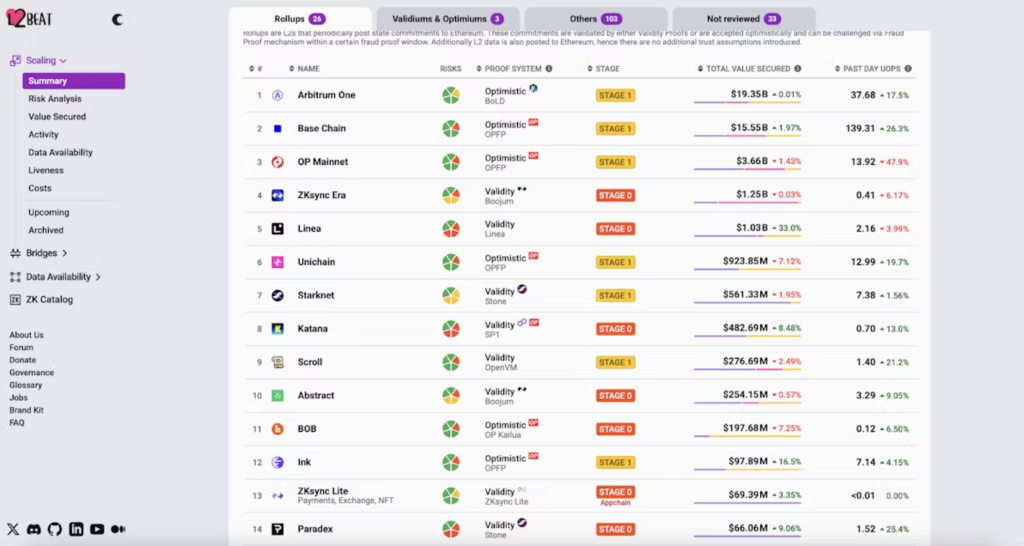

Bitcoin also had an L2 — LN — but it is Ethereum that has optimistic and ZK-rollups. And those are large stacks: look at the Superchain family or Arbitrum’s products.

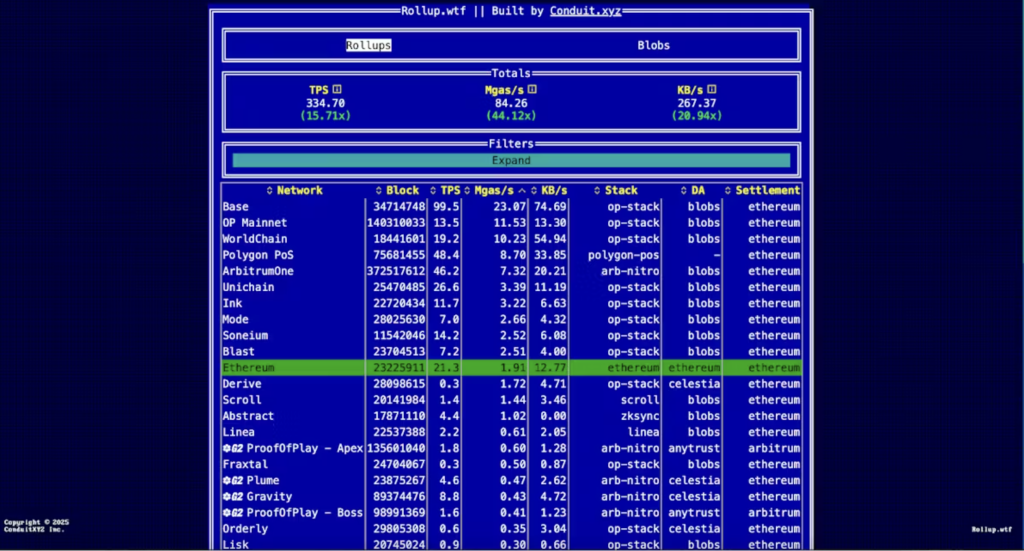

Even with new L2s appearing on Bitcoin in 2023–2025, there is little to compare: the lead remains Ethereum’s. A glance at the numbers and the progress suffices:

Or even here:

Again, it is clear why ether is so far ahead: it turned L2 into practical sharding (unlike Solana, Near or even Zilliqa). But since Bitcoin has chosen to compete on that field, the comparison is fair.

EVM

Even when Ethereum lacks something, it tends to appear on EVM-compatible — not Bitcoin-compatible — chains. Consider:

- Sonic;

- Avalanche;

- Polkadot (Moonbeam);

- Cosmos (EVMos);

- Solana (Neon);

- Near (Aurora);

- HyperLiquid;

- Tezos (EtherLink).

Economically, many of these projects also owe much to ether. Polkadot, Cosmos, Tezos, TRON and others — all ICOs on Ethereum. Avalanche, originally positioned to rival Polkadot and Cosmos as a multichain solution, is EVM-compatible too.

Moreover, quite a few are ready to become L2s on Ethereum to fit into the decentralisation economy — for example, Lisk and Berachain.

Wallets

We have assessed decentralisation from the standpoint of core participants. Now let us look at the client side.

For Bitcoin one can see the following:

In Ethereum, the picture looks like this:

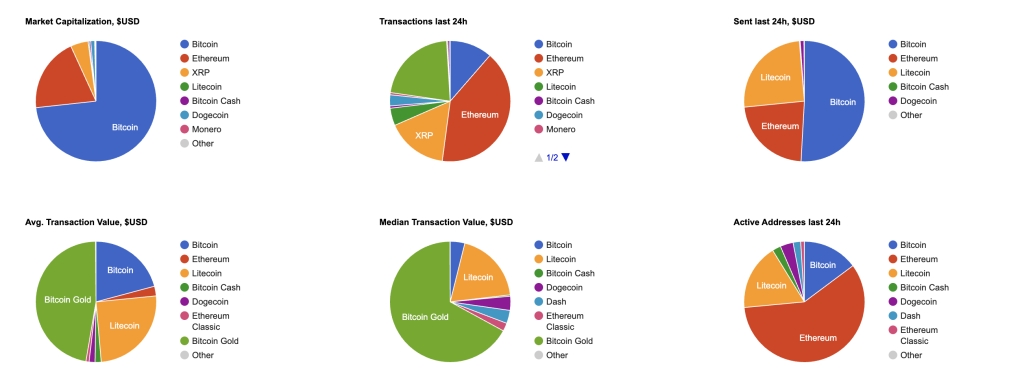

At times ether has outpaced bitcoin in growth rates — to quote: “Bitcoin has 140 times more daily active addresses than XRP, but fewer addresses with a positive balance than ETH.” It looked like this:

As of 2023, ether had over 100m wallets with a non-zero balance.

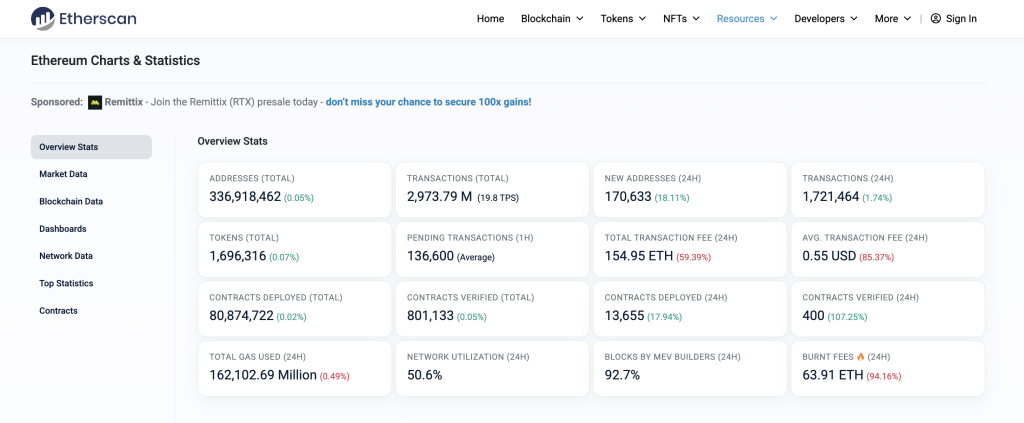

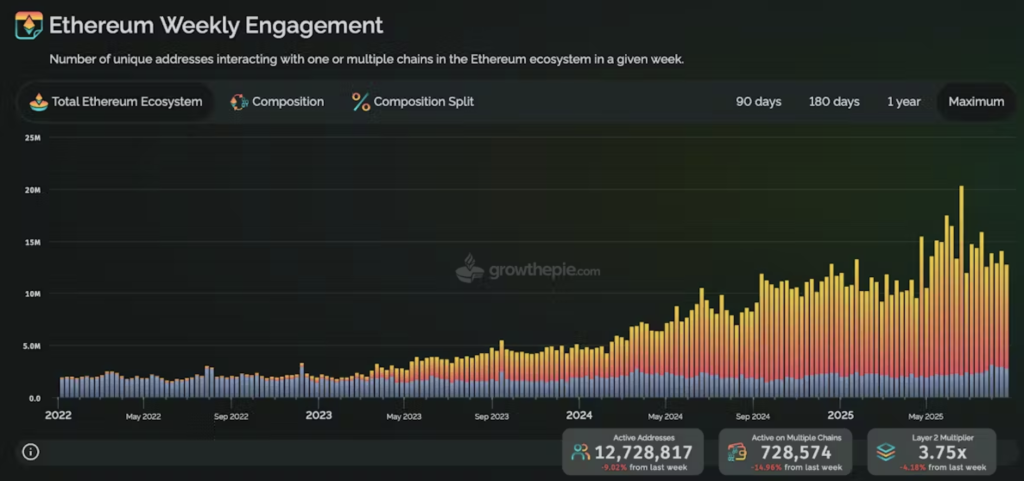

Now let us look at the live view:

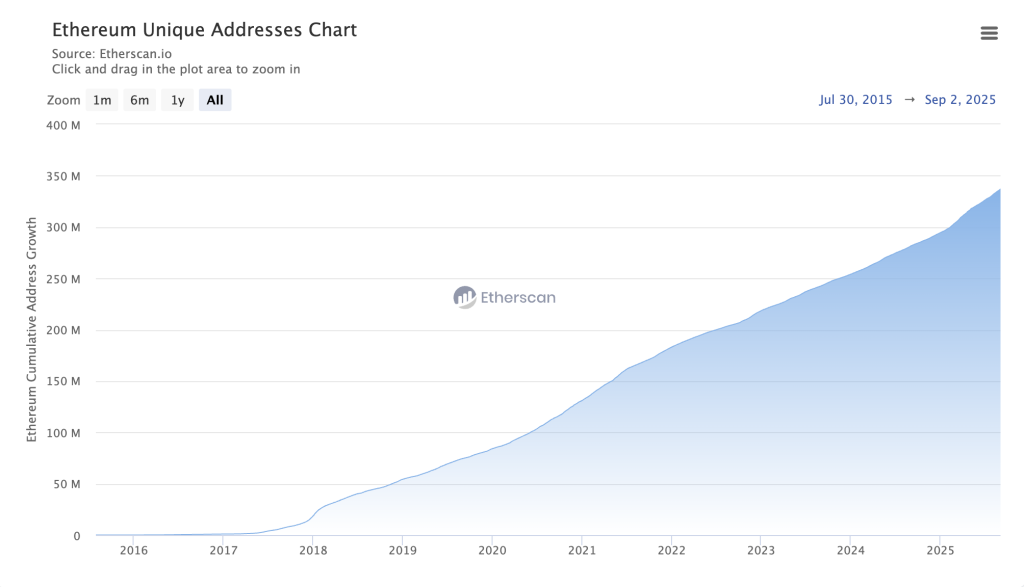

By activity, ether is plainly ahead. Today there are almost 350m wallets:

While Bitcoin can boast only 50m unique addresses with a non-zero balance, ether is also seeing growth in wallet interactions:

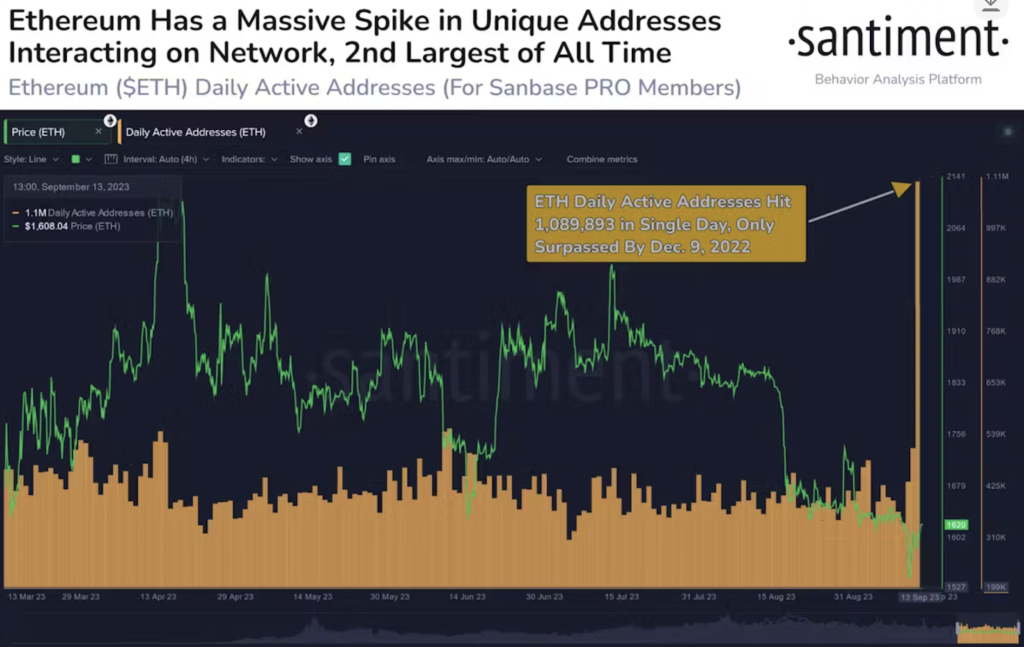

Against that backdrop, a figure of 120m does not look implausible. And, to reiterate, the growth in unique addresses on Ethereum has been a constant. One more example:

DEX and CEX

Where can you buy and swap BTC and ETH? On CEX and DEX of various kinds. There are still relatively few bridges to Bitcoin, while to ether there are very many — with liquidity rising. And there are far more DEX on Ethereum and the EVM. Is that not a form of decentralisation?

Thanks to the EVM, we have:

- dYdX — the leader of past seasons;

- HYPE — the current leader;

- Derive — an options innovator;

- and dozens upon dozens more.

And that is only part of DeFi. There, Ethereum’s leadership is unequivocal — and precisely on decentralisation: a vast number of protocols, a rich ecosystem, and so on. A quick glance suffices.

DeFi

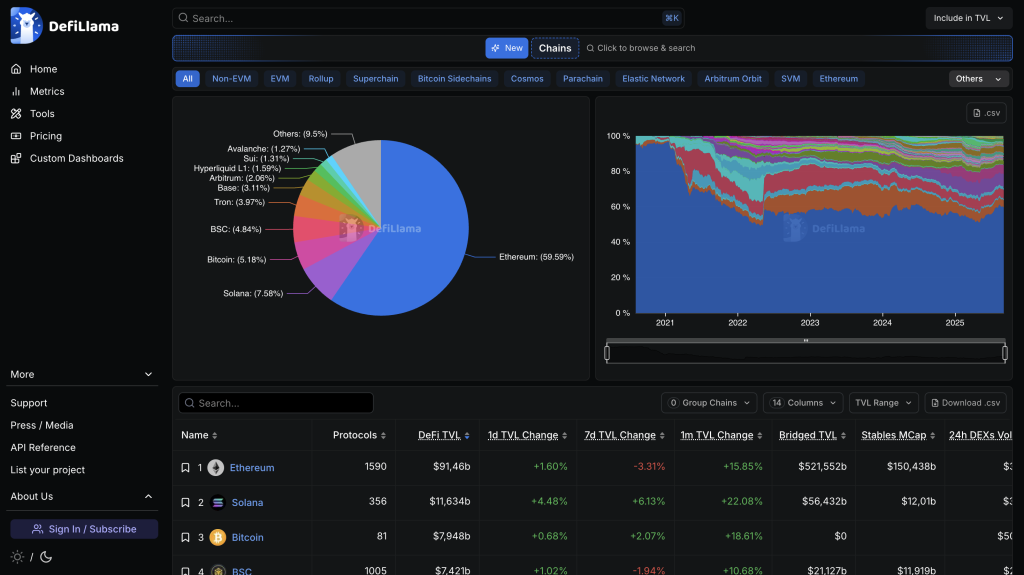

Here are the data:

Add Base, Arbitrum and so on to ether, and you will be surprised how (for now) helpless Bitcoin looks.

Yes, getting BTC from fiat can be easier at times — via ATMs. But how much more significant are they than Ethereum’s OTC venues, exchangers and card aggregators is a big, separate question.

Enthusiasts

Bitcoin has Satoshi, ether has Vitalik. Beyond Buterin, Ethereum has many other devotees, whereas digital gold has far fewer. Draw your own conclusions.

Speaking of community, it is more important to recall that, in response to the The DAO case, there was the great Bitcoin bug of 2010. Keep that in mind when citing the collapse of Buterin’s project as proof of Ethereum’s centralisation.

Conclusion

I do not know why BTC and ETH maximalists arise. But it seems to me that today Bitcoin lags ether on many counts. It keeps playing catch-up, without offering innovation.

That said, since Nietzsche the labels “good” and “bad” have lost their force. In a world where breadth of reach matters more than depth of embedding — and where the blockchain trilemma is security, scaling and decentralisation itself — such categories are even less meaningful.

A thorough comparison of giants like ether and Bitcoin would take not 17 pages of text and charts but ten times as much — more likely a hundred. Still, to me it is obvious there are no clear signs of greater decentralisation in the Bitcoin ecosystem than in Ethereum’s — there never were.

For the avoidance of doubt: I value both projects, and both coins have always been in my portfolio, but they play different roles: BTC as a base hedge; ETH as a base collateral asset. That, too, is a sound approach to decentralisation.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!