A key market relationship is starting to crack.

For the first time in nearly 10 years, Bitcoin and the S&P 500 are on track to finish a year with opposite returns. Stocks are up decisively. Bitcoin is not.

Bloomberg reported that BTC is down roughly 3 percent year-to-date, even after climbing back toward the 90k range this week. The S&P 500, meanwhile, is up about 16 percent for 2025, powered by tech resilience and a steady rotation into AI-focused equities.

The November Damage Is Still There

Bitcoin’s problem is simple. It hasn’t fully recovered from the November drawdown, when it lost almost 25% in a single month. While stocks marched higher, Bitcoin’s bounce stalled, leaving the two assets on divergent annual paths.

That divergence is in the year-to-date returns, not necessarily in daily price correlation. Analysts note that BTC and equities still move together much of the time.

What’s shifting is performance, not behavior.

Why Investors Are Pulling Back

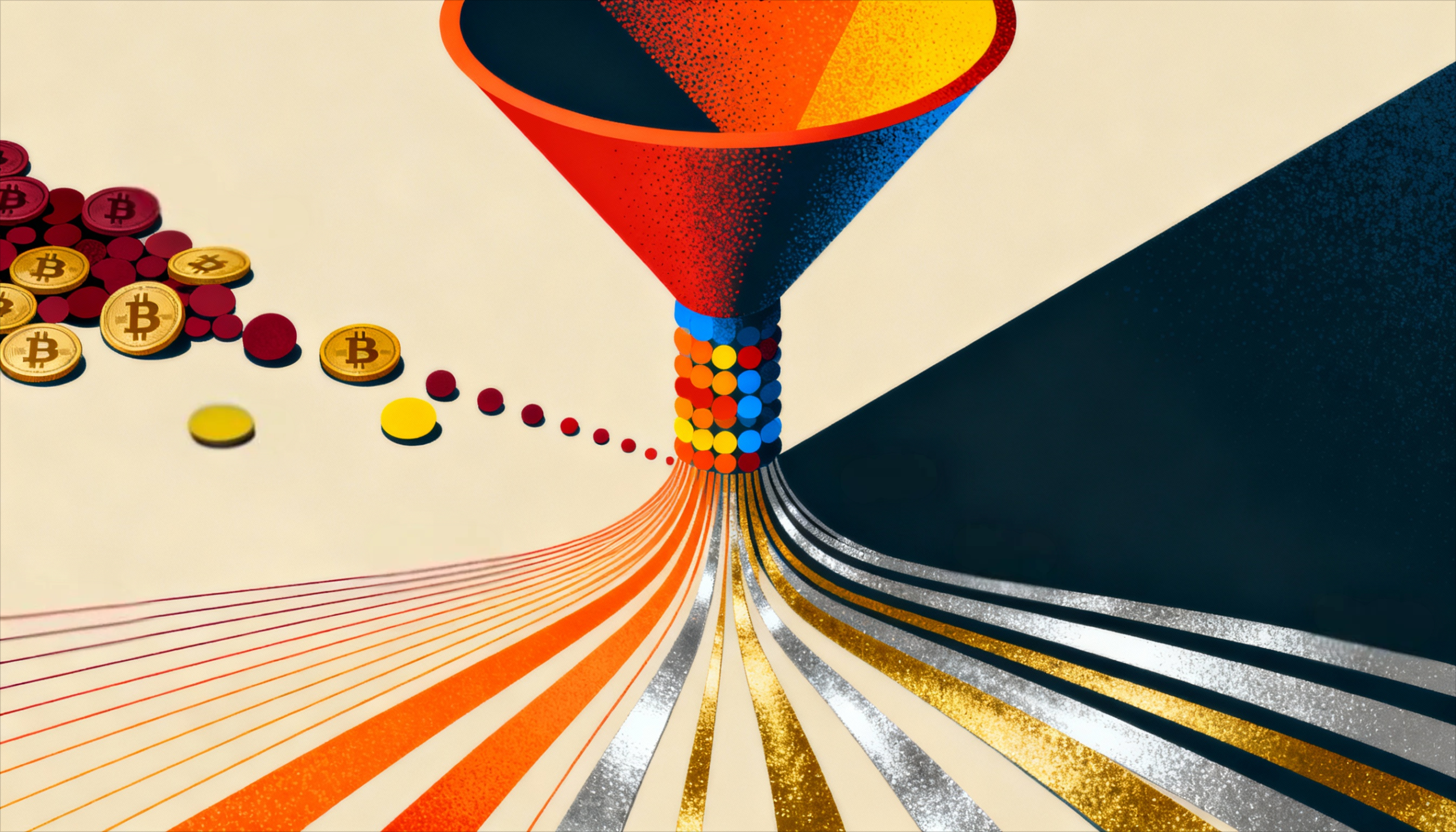

The report points to a clear capital rotation:

- Institutional money has been flowing into gold and silver, both of which surged through late 2025.

- Defensive sectors have outperformed the more speculative corners of the market.

- Bitcoin ETF inflows slowed sharply in Q4, breaking the pattern that drove the 2024 rally.

In short, the risk appetite that once lifted Bitcoin faster than tech stocks has cooled.

ETF Tailwind Fades

The massive “eternal bid” created by 2024’s spot ETF boom isn’t gone, but it isn’t accelerating. ETF flows have flattened out, leaving Bitcoin reliant on organic buying rather than structural inflows.

Without that constant pressure, BTC’s recovery from the November rout has been slower and more fragile.

Is This Actually Bad? Not Necessarily

A year-to-date divergence isn’t the same as long-term decoupling. But it does flip the narrative.

For two years, Bitcoin behaved like high-beta tech: whatever stocks did, Bitcoin did louder.

If markets hit turbulence in 2026 (something several macro strategists expect) a Bitcoin that is no longer glued to equities could be a positive. But right now, it is not trading like a hedge. It’s simply underperforming.

Bottom Line

Bitcoin is heading into year-end with a rare negative divergence from the S&P 500: BTC down ~3%. Stocks up ~16%.

It’s the first time in a decade the two markets are finishing with opposite signs.

Capital is flowing into metals, defensive assets, and away from crypto…and ETF momentum seems not to be enough to counter that rotation.