Bitcoin, the market’s “digital gold,” reached $121,000 for the first time since mid-August, when it set a record above $124,000. The second-largest cryptocurrency climbed to $4,500, a three-week high.

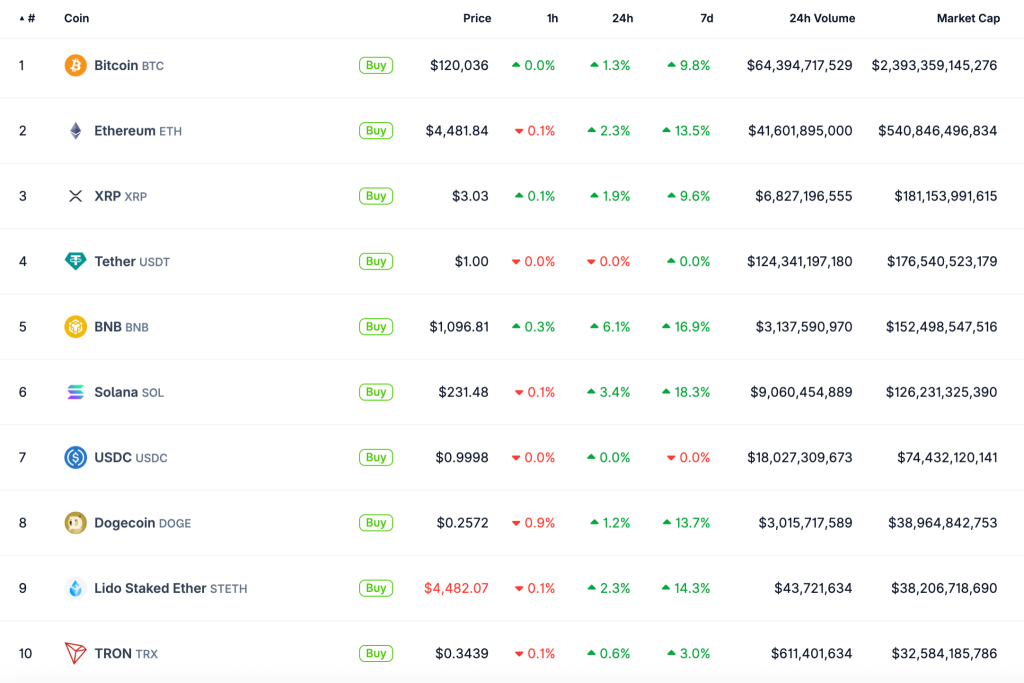

At the time of writing, bitcoin trades around $120,000, up 1.3% over the past 24 hours.

Ethereum has moved more briskly, adding 2.4% over the past 24 hours. The asset trades near $4,500.

Over the week, Ether gained 13.5% versus Bitcoin’s 2.5%. CryptoQuant analyst Axel Adler Jr noted that over the last quarter ETH has nearly matched BTC’s pace of gains.

Over the last quarter, Ethereum has nearly matched Bitcoin in annual performance. pic.twitter.com/ku0YEdxKCP

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 3, 2025

Bulls in control

Total crypto market capitalisation rose 1.4% to $4.2 trillion. Every top-10 asset by market value advanced; standouts included BNB (+6.1%) and Solana (+3.4%).

On a weekly basis, the altcoin rally was led by privacy coins — Zcash (+148% week on week) and Dash (+64%).

The latest upswing was not accompanied by a cascade of liquidations. Over the past 24 hours the tally reached $385m.

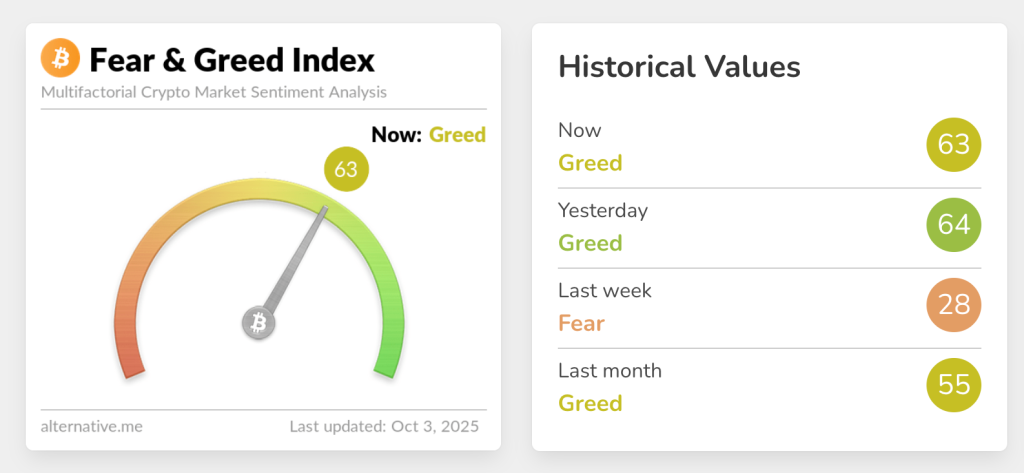

Fear Index returned to the “greed” zone, signalling broadly bullish investor sentiment.

What is driving the crypto rally?

One likely driver is the US government shutdown that began on 1 October. Market participants earlier noted that in three of the past five shutdowns Bitcoin’s price rose.

Historically, such episodes have not weighed on risk assets. According to The Kobeissi Letter, the S&P 500 has finished higher during every shutdown since 1995.

The near-term effects bring more volatility.

The S&P 500 tends to finish higher in just ~55% of cases at the end of the shutdown.

In the 1970s and 1980s, this typically came with a sharp downturn.

However, the S&P 500 has finished higher during every shutdown since 1995. pic.twitter.com/CvMDF7aNhd

— The Kobeissi Letter (@KobeissiLetter) September 30, 2025

Amid the budget shortfall and rising inflation a shutdown can induce, investors are turning to risk assets as a hedge. As Bloomberg reports, market participants expect capital to flow into cryptocurrencies.

Another positive factor is the return of steady inflows into spot ETFs backed by bitcoin and Ethereum. Over the past week, bitcoin-focused funds took in $2.2bn — the most since mid-September.

Vehicles tied to the second-largest cryptocurrency attracted more than $1bn, the first time since late August.

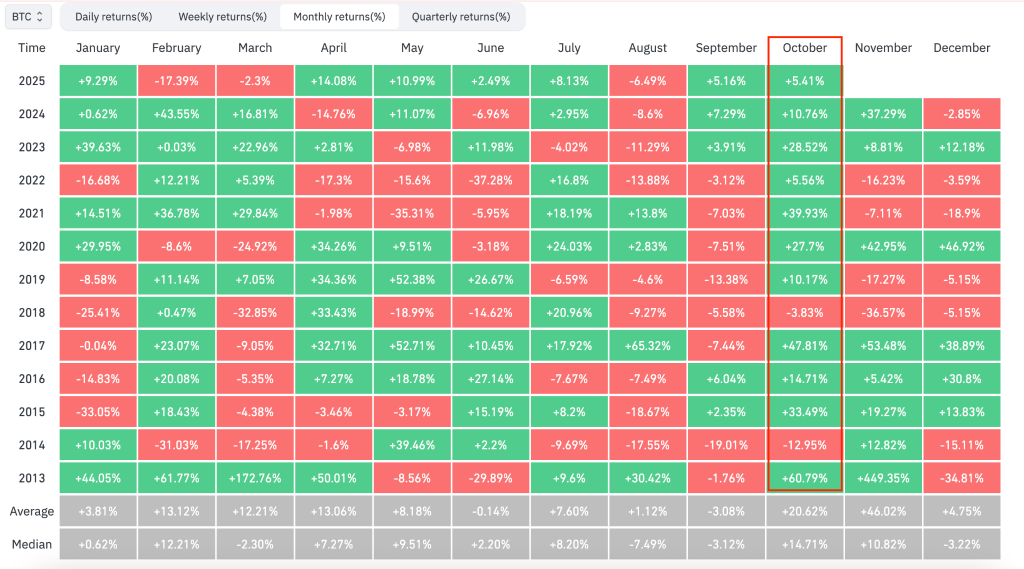

Seasonality matters too. In crypto circles October is nicknamed Uptober: historically, Bitcoin has almost always delivered positive returns this month, averaging about 20.6%.

“September traditionally shows the worst performance for Bitcoin on an annual basis, whereas the fourth quarter consistently delivers the best results. I am not a huge fan of seasonality, but I must admit: these patterns often have a self-reinforcing effect,” said Syncracy Capital co-founder Ryan Watkins in a comment to Bloomberg.

Optimism is also buoyed by expectations of a second key-rate cut by the Fed in October. Nearly 98% of market participants are betting on further monetary easing.

Earlier, experts confirmed Bitcoin’s “healthy dynamics” and forecast a rise to $200,000 by year-end.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!