Bitcoin has already had a huge year – new highs, billions flowing into ETFs, and a crypto market that’s been buzzing nonstop. But the past week hasn’t been so kind. BTC’s price has slid back under $114,000, down more than 8% from last week’s peak.

Moves like this aren’t unusual. Crypto tends to move in bursts, and pullbacks often flush out the overleveraged before the next leg higher. The question now is whether we see one more dip before Bitcoin pushes toward a new target – potentially as high as $130,000.

That kind of rebound would set the stage for Bitcoin-linked altcoins to run even harder. One that’s getting lots of attention is Bitcoin Hyper, a new Layer-2 network built to bring Solana-like speed and smart contracts to the Bitcoin blockchain.

Bitcoin’s Price Slides on ETF Outflows and Dollar Strength

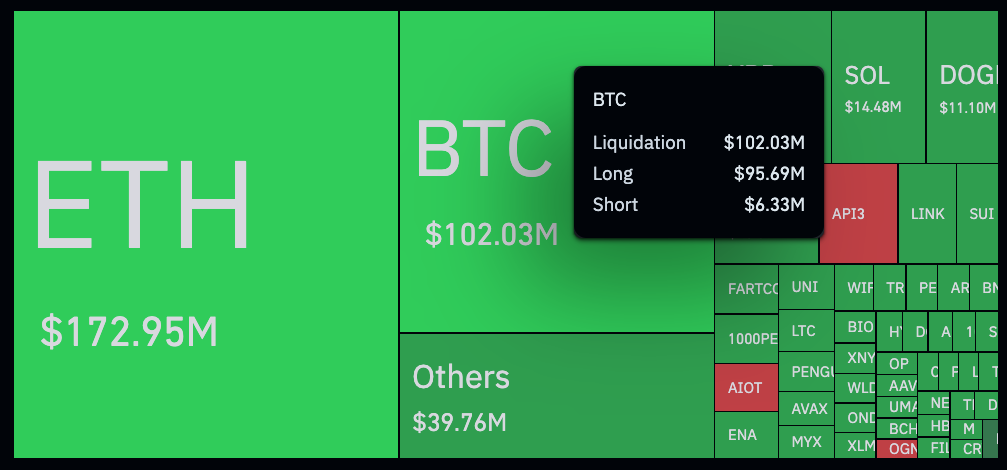

Bitcoin is currently sitting around $113,800, its lowest price in two weeks after a pullback from Thursday’s all-time high. The 4-hour chart has rolled into a downtrend, open interest is thinning out, and nearly $100 million in longs got liquidated in the past day alone.

The biggest headwind is coming from spot ETFs. Yesterday, these ETFs saw $523 million flow out – the biggest single-day withdrawal in over a month. Fidelity’s FBTC led with nearly $247 million in redemptions, while Grayscale’s GBTC shed about $115 million.

Plus, the U.S. dollar is looking strong again. New tariffs have pushed the DXY up about 3%, and with Bitcoin’s correlation to the dollar sitting at -0.76, it’s not surprising to see weakness here.

A stronger dollar equals a weaker Bitcoin, at least in the short term. Longer term, though, those same trade frictions could boost Bitcoin’s use case as a hedge against inflation.

Bitcoin Price Prediction – Could BTC Reach $130K Soon?

The charts suggest that Bitcoin might not be finished with its pullback just yet. Its next major support level sits around $100,000 – a level the market hasn’t seen since late June. A move down to there would shave another 12% off the current BTC price.

What makes $100,000 so important is the sheer amount of demand waiting there. Market depth shows a stack of buy orders clustered around that level, and when Bitcoin dipped to $100,000 in June, buyers stepped in aggressively and drove a sharp rebound.

If history repeats itself, such a rebound could form a head-and-shoulders pattern on the daily chart. This setup often signals the potential for a breakout. And should that happen, the next big round-number target is $130,000, which would represent a 30% rally from $100,000 support.

Why Low-Cap Altcoins Like Bitcoin Hyper Could Benefit From a BTC Rebound

If Bitcoin does pull back to $100,000 and then rallies, altcoins will almost certainly react. It’s a pattern the market’s seen countless times: once Bitcoin finds its footing, money starts spilling into smaller tokens. And right now, the spotlight is on Bitcoin-linked altcoins like Bitcoin Hyper.

Bitcoin Hyper is building a Layer-2 network that runs the Solana Virtual Machine (SVM) on top of Bitcoin, which means higher throughput, lower fees, and smart contracts all anchored to BTC’s blockchain. In simple terms, it’s about making Bitcoin faster and more versatile.

Imagine using Bitcoin not just for payments but for DeFi protocols, NFT marketplaces, or even crypto gaming apps. That’s the kind of expansion Bitcoin Hyper’s team is pushing for.

It’s still early days, but the response has been impressive. Bitcoin Hyper’s presale has already raised over $10.8 million, with HYPER tokens available for just $0.012765 each. Experts at 99Bitcoins have even suggested HYPER could 100x after hitting the open market.

On top of that, staking rewards are still sitting at 101% per year, giving early investors plenty of incentive to HODL. That helps explain why more than 517 million HYPER tokens have been staked already.

By combining Bitcoin’s brand strength with Solana-like performance, Bitcoin Hyper is pitching itself as the “bridge” between Bitcoin’s security and the programmability investors have long wanted. It’s an ambitious goal – and it could reshape how people think about using Bitcoin.