Nick Tomaino, co-founder of Galaxy Digital, has raised concerns over the concentration of power in the hands of Michael Saylor, founder of MicroStrategy, suggesting that Saylor’s voting control could undermine the potential of Bitcoin’s gains and shift Wall Street’s attention toward Ethereum. Tomaino’s remarks highlight a growing debate within the crypto community about governance structures and the implications for investor confidence, particularly as Bitcoin continues to see surges in price amid broader market optimism.

Ethereum, the second-largest cryptocurrency by market capitalization, has recently set a new all-time high of $4,878, driven in part by the increasing adoption of digital asset treasuries and the approval of spot Ethereum ETFs by the SEC in July 2024. These ETFs now hold over $20 billion in assets under management, led by BlackRock’s ETHA, and have contributed to Ethereum’s rising inflows and market dominance. The growing trend of Ethereum-focused treasuries, such as those operated by BitMine and SharpLink Gaming, has also played a key role, collectively holding over $10 billion in ETH. This increased institutional interest underscores Ethereum’s appeal as a platform for financial innovation and scalability.

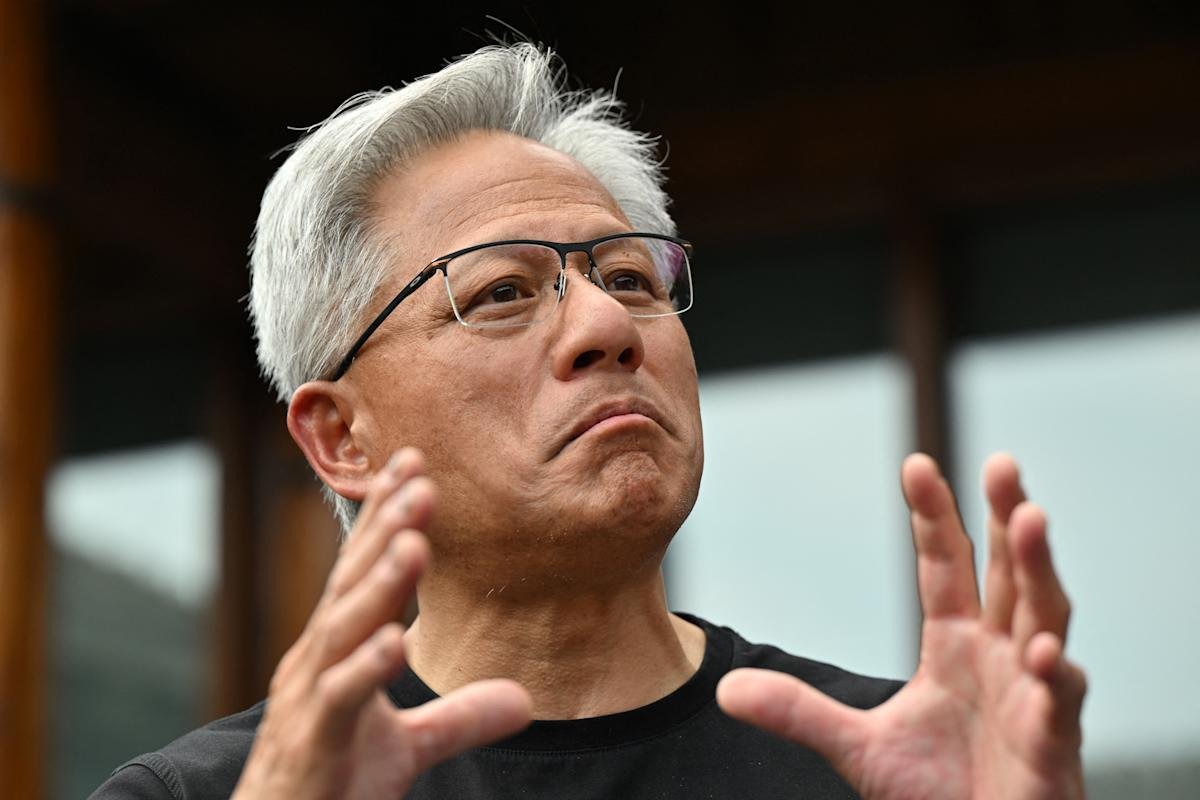

Arthur Hayes, founder of BitMEX, has recently revised his Ethereum price forecasts, suggesting the asset could reach as high as $20,000 by the end of the current market cycle. Hayes attributed this potential rise to anticipated monetary expansion under a potential Trump administration, particularly through quantitative easing measures. His bullish stance aligns with broader market sentiment, as Ethereum’s price has surged more than 40% in 2025, outpacing Bitcoin’s performance. The asset’s recent price momentum has been supported by a combination of favorable macroeconomic factors, including dovish commentary from Federal Reserve Chair Jerome Powell, which suggested an upcoming rate cut.

Meanwhile, Ethereum’s technological evolution has further reinforced its position in the market. The Pectra upgrade in May improved the platform’s staking efficiency, user experience, and Layer 2 scalability, contributing to a 20% price surge at the time. Industry leaders like Joe Lubin, founder of Consensys, have emphasized Ethereum’s role as a foundational infrastructure for future financial and commercial systems, highlighting its potential for securing transactions between human and AI agents. As the crypto market continues to evolve, Ethereum’s adaptability and innovation are increasingly viewed as critical advantages over more rigid systems.

In contrast, Bitcoin’s recent price surge to $117,300 has sparked significant short liquidations and renewed bullish momentum among traders. Federal Reserve Chair Jerome Powell’s comments at Jackson Hole signaled a potential rate cut, prompting a broader market rally that benefited both Bitcoin and Ethereum. Analysts such as Michael van de Poppe have emphasized that the Bitcoin uptrend appears to have resumed, with price targets as high as $200,000 by year-end. However, as Tomaino pointed out, the concentration of voting power in the hands of individual leaders like Saylor could create governance risks that shift investor focus toward Ethereum, particularly as the latter continues to attract institutional and retail capital.

The ongoing competition between Bitcoin and Ethereum remains a central theme in the crypto space, with each asset representing different values and use cases. Jack Dorsey, co-founder of Twitter, framed the debate as a philosophical choice between speed and security, suggesting that Ethereum’s rapid innovation and Bitcoin’s deliberate development reflect different visions for the future. As the crypto market matures, the balance between decentralization, security, and scalability will continue to influence investor sentiment and long-term adoption.

Source:

[1] Why Arthur Hayes Expects Ethereum to Surge to $20,000 (https://finance.yahoo.com/news/why-arthur-hayes-expects-ethereum-210103605.html)

[2] Ethereum hits fresh all-time high amid wider market rally (https://www.theblock.co/post/366657/shell-dnp-ethereum-hits-new-all-time-high-price-as-eth-crosses-4900-for-the-first-time-ever)

[3] Bitcoin News: Eric Trump’s BTC Price Predictions (https://www.coindesk.com/business/2025/08/23/eric-trump-makes-bitcoin-price-predictions-as-he-reportedly-gets-ready-to-visit-metaplanet)

[4] Jack Dorsey Says There’s Only One Way To Choose Between Bitcoin and Ethereum (https://finance.yahoo.com/news/jack-dorsey-says-theres-only-123727966.html)

[5] Bitcoin price breakout to $117K liquidates bears, opening door to fresh all-time highs (https://cointelegraph.com/news/bitcoin-price-breakout-to-dollar117k-liquidates-bears-opening-door-to-fresh-all-time-highs)