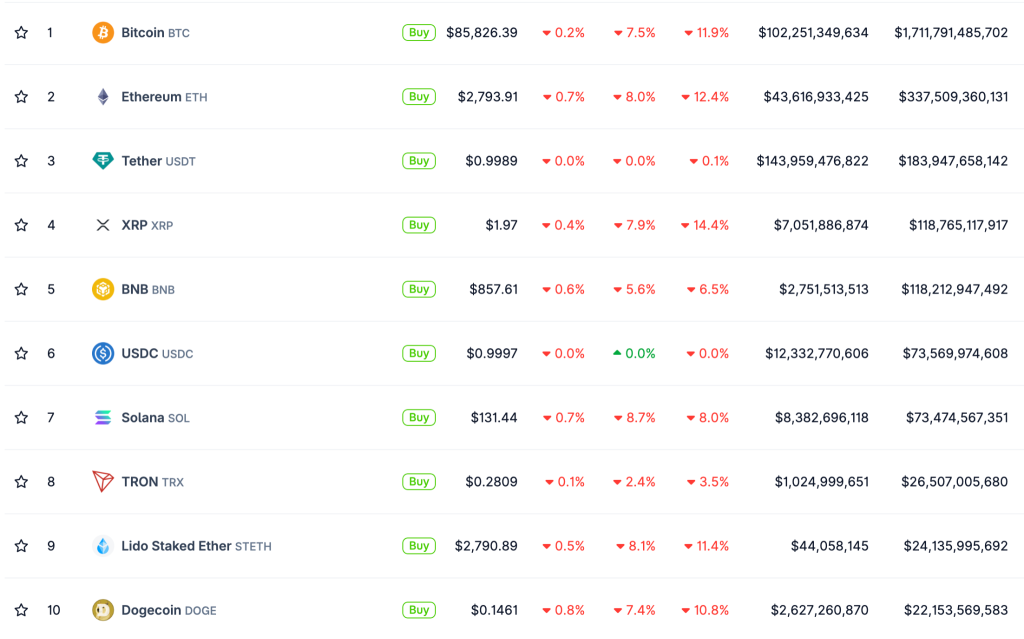

Ether fell to $2,700.

Over the past 24 hours, the price of the leading cryptocurrency fell 7% to about $84,000—its lowest since April.

Ether dropped 8.1% to $2,700.

All top-ten cryptocurrencies by market capitalisation were in the red. The steepest losses were in Solana (-8.7% over 24 hours) and XRP (-7.9%).

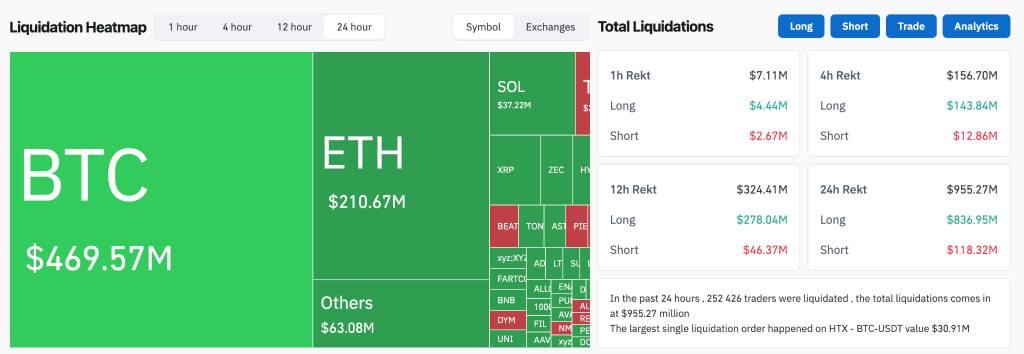

Liquidations topped $955 million, mostly in long positions at $836 million.

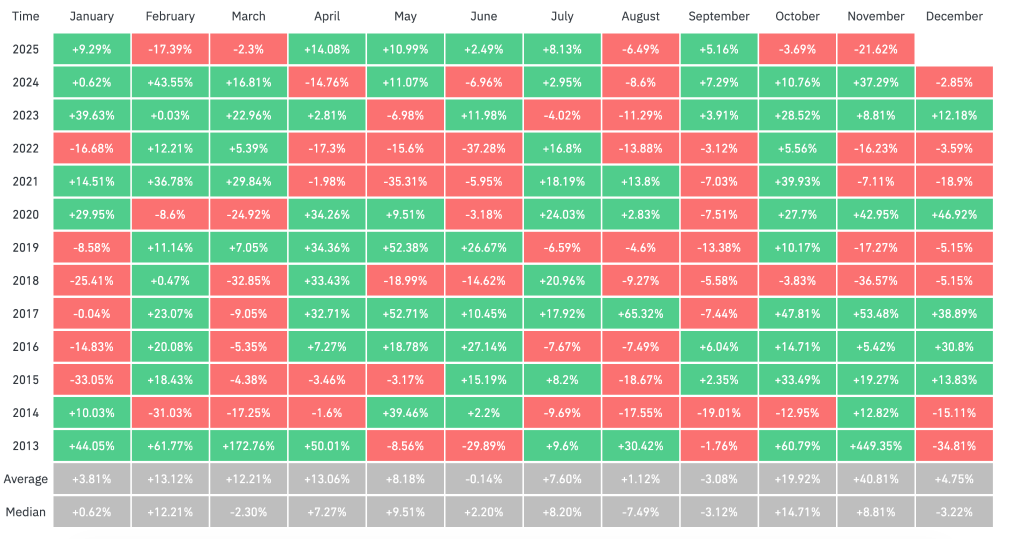

November 2025 is shaping up to be one of the worst months for ‘digital gold’. Since the start of the month, the asset has dropped 21.6%. Ether shows a similar pattern, down more than 27% over the same period.

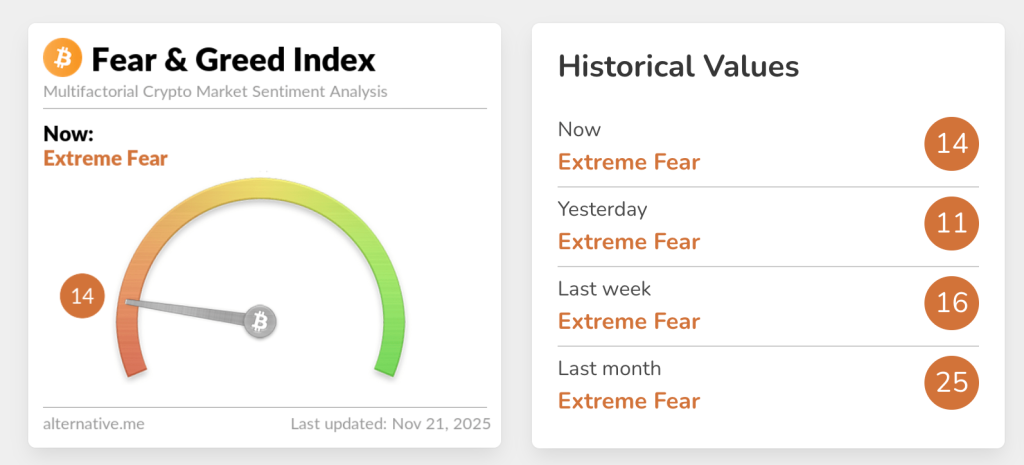

A popular market-sentiment gauge remains in “extreme fear”, signalling uncertainty and panic among investors.

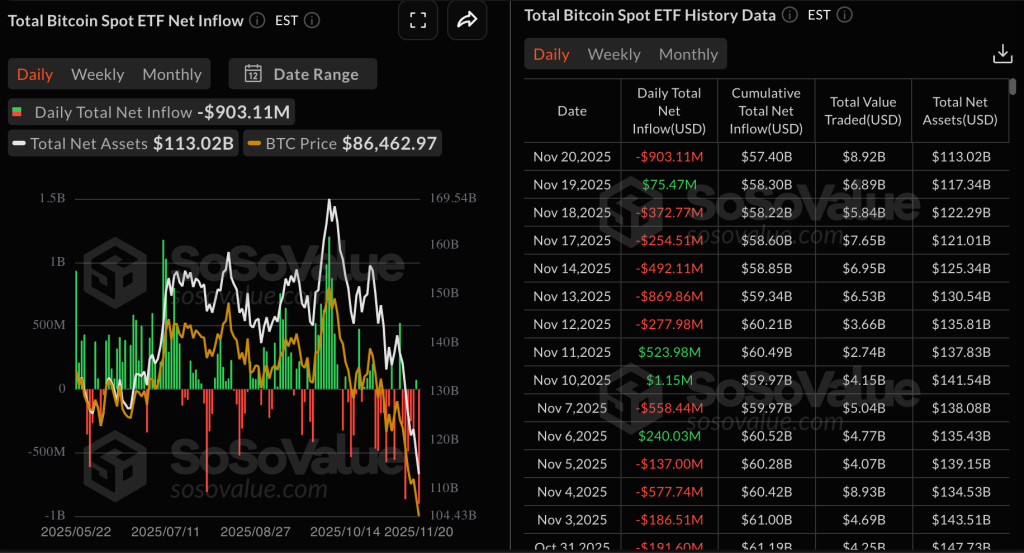

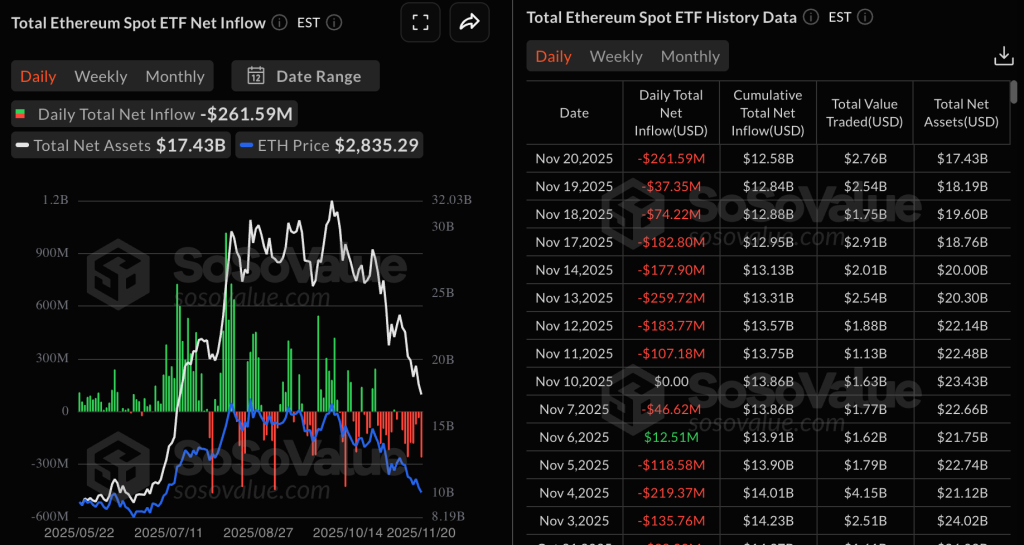

ETFs

Amid the latest broad correction, spot bitcoin ETFs saw $903 million of outflows—the second-worst tally since the instruments launched in 2024. The record was set in February, when outflows exceeded $1 billion.

On November 19, the bitcoin funds attracted $75 million, breaking a five-day negative streak.

Ethereum-focused products continued to register outflows for an eighth straight day, losing $261 million in the past 24 hours.

XRP ETFs from Canary and Bitwise attracted $118 million. Solana funds reported total inflows of $23 million.

What drove the sell-off

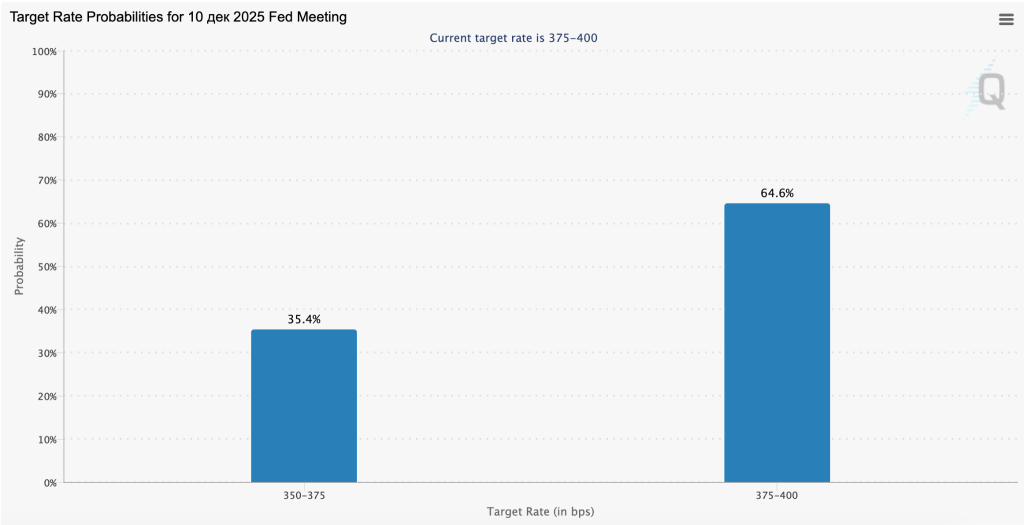

Kronos Research’s chief investment officer, Vincent Lyu, noted that the correction is linked to stronger-than-expected US employment data for September. The figures were due in early October but were delayed by the government shutdown.

The economy added 119,000 jobs—the biggest jump since December. Unemployment rose to 4.4%. However, this reflects increased labour supply.

According to the executive, the report reduced expectations of a rate cut by the Fed in December. The central bank will have to decide on the basis of less current data—October and November are missing from the statistics.

“Liquidity remains low, and short-term profit taking exacerbates the move. The market is repricing risks in response to macro data,” Lyu added in a comment.

Investors now put the odds of policy easing at 35.4%. At the start of the month, that stood at 98%.

If the Fed forgoes a key rate cut, ‘digital gold’ risks sliding to $60,000, according to XWIN Research analysts.

Even so, LVRG’s research director Nick Ruck said the crypto-market decline is a “healthy repricing of overstretched positions” that built up during the previous rally.

“Blockchain data show stabilisation of selling pressure in spot and futures markets—this indicates the capitulation phase is almost over,” he said.

The drop in the Nasdaq Composite, which tracks large technology stocks, added to the gloom. Despite a strong Nvidia quarterly report, the gauge fell 4%, prompting an exodus from risk assets.

Investors are uneasy about the rapid rise in AI-related spending. Lately, many point to signs of overheating in this corner of the market. Billionaire Ray Dalio told CNBC that the market is not yet on the verge of a crash but is “already in bubble territory”.

Analysts at JPMorgan reckon the correction is driven mainly by retail selling via spot bitcoin and Ethereum ETFs.

“If October’s market decline was the result of aggressive deleveraging by crypto traders via perpetuals, that process ended in November. Further losses were driven by traditional investors—mostly retail—who use spot exchange-traded funds to access the crypto market,” said Nikos Panigirtzoglou.

“The best thing that could happen to Bitcoin”

Veteran trader Peter Brandt said the first cryptocurrency will not reach $200,000 by year-end. He believes it will take at least four years to get there.

Full disclosure folks

Of my maximum ever Bitcoin position I still own 40%, at a price 1/20th of Saylor’s avg buy.

I am a long-term bull on Bitcoin. This dumping is the best thing that could happen to Bitcoin. The next bull market in Bitcoin should take us to $200,000 or so. That…— Peter Brandt (@PeterLBrandt) November 21, 2025

“The next bull market in bitcoin should take the price to $200,000. That will happen around the third quarter of 2029,” he wrote.

The trader also called the current correction healthy for the market:

“This sell-off is the best thing that could have happened to bitcoin.”

Brandt’s forecast contrasts with the views of several prominent bitcoin advocates. BitMEX cofounder Arthur Hayes and BitMine chief Tom Lee, for example, expect bitcoin to breach $200,000 by the end of 2025.

Earlier, Glassnode specialists identified a level that would confirm a bear-market phase.

They previously said that bulls must restore the bitcoin price as soon as possible to a level at which 75% of coins are in profit—only this has historically stopped a trend reversal.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!