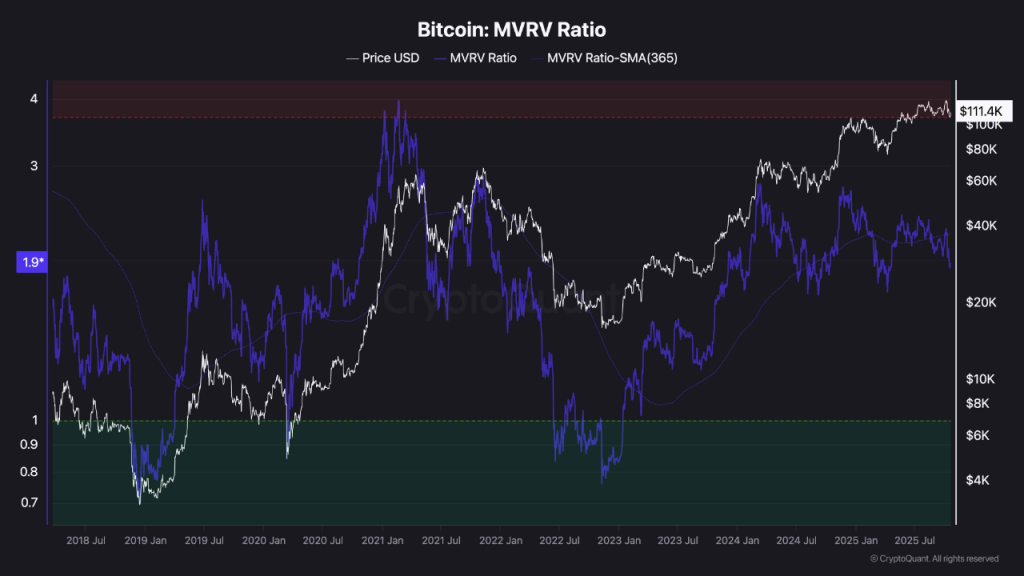

The MVRV ratio for the leading cryptocurrency has fallen below the 365-day simple moving average (SMA), indicating a local bottom. This was highlighted by contributors from CryptoQuant at ShayanMarkets.

At the time of writing, the indicator stands at approximately 1.9.

“Historically, every time the ratio fell below the 365-SMA, it signaled a buying opportunity and a bottom. This was observed in mid-2021, June 2022, and early 2024,” experts noted.

In their view, the consistent trend indicates that Bitcoin is once again “entering an undervalued phase, where long-term holders typically begin to accumulate the asset.”

The MVRV decreased after the digital gold fell to $103,000, “reflecting a reduction in speculative excess and an increase in long-term confidence,” ShayanMarkets pointed out.

“If the indicator starts to rise from current levels, it will confirm that the recent sell-off was a cyclical bottom formation, warning of a resumption of the bullish phase in the fourth quarter,” the researchers concluded.

Comparison with Gold

Analyst Michaël van de Poppe noted that gold dropped significantly, correcting by more than 8% in a day. Initially, Bitcoin moved contrary to the precious metal but then also declined.

A pretty harsh move on Gold, as it corrected by more than 8% on a day.

Initially, #Bitcoin moved up massively, but gave it back as well.

I don’t think that this will last. The volatility on Gold is super high, that’s due to the fact that it’s a massive outlier which we’ve… pic.twitter.com/5pEt9Zi99g

— Michaël van de Poppe (@CryptoMichNL) October 22, 2025

“I don’t think this will last long. The volatility of gold is very high and is associated with the sharp price increase we’ve seen in recent months. I assume gold has now peaked, which means funds should be redirected to other assets,” he added.

According to the analyst, a weak consumer price index should serve as an impetus for potential rate cuts and the end of the U.S. government shutdown. After this, Bitcoin will begin to rise as “risk appetite regains strength.”

Meanwhile, Bitwise suggested that a potential 5% capital rotation from gold to Bitcoin could lead to the first cryptocurrency’s price rising to $240,000.

Bitwise says a 5% capital rotation from gold to Bitcoin could send BTC to $242,391 👀 pic.twitter.com/FwvjneWhdX

— Bitcoin Archive (@BTC_Archive) October 21, 2025

Back in earlier reports, Bitwise’s Chief Investment Officer Matt Hougan explained the lag of digital currency behind the precious metal.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!