Kyrgyzstan and Kazakhstan moved toward creating national bitcoin reserves; Belarus signalled a push to adopt cryptocurrencies; the Winklevosses’ Gemini listed on Nasdaq; and other highlights from the week.

Markets await the Fed meeting

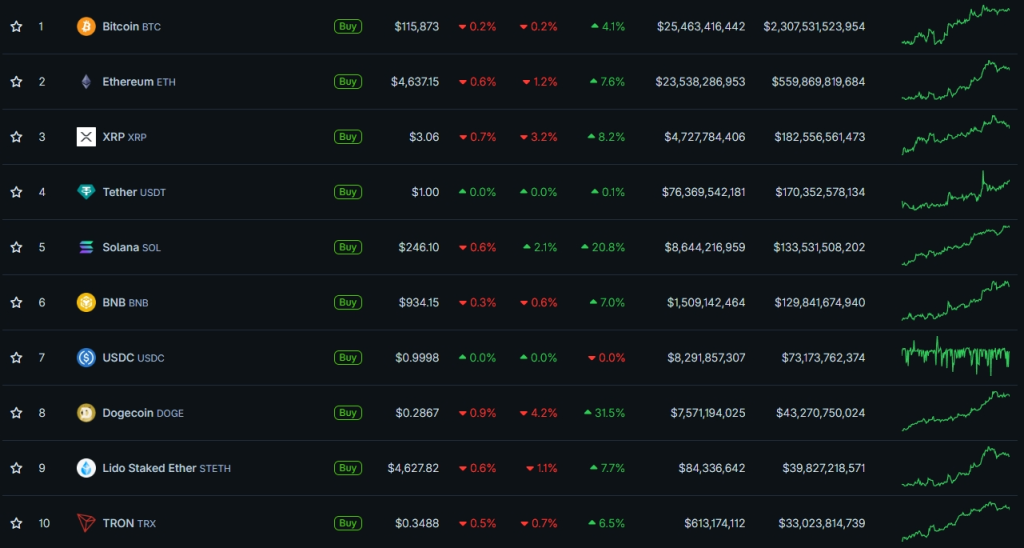

Bitcoin extended its uptrend. By the end of the workweek, the price topped $116,500. The digital gold failed to hold those levels and over the weekend eased to about $115,500.

Most analysts expect a bullish impulse from the ФРС meeting on September 16–17. Market participants are confident the regulator will cut the policy rate, historically a boon for risk assets such as cryptocurrencies. Some traders, however, reckon the move is already priced in.

Over seven days, bitcoin rose 4.1%. The largest altcoins by market capitalisation outpaced the benchmark: Dogecoin gained 31.5%, Solana 20.8%.

Ether and XRP rose 7.6% and 8.2%, respectively.

Crypto market capitalisation increased to $4.15 trillion; bitcoin’s dominance fell over the week from 56.4% to 55.6%. Meanwhile, the second-largest asset’s share edged up to 13.5% from 13.2%.

According to CoinMarketCap, the altseason index reached 66 points versus 53 a week earlier, nearing the 75/100 threshold.

The Crypto Fear and Greed Index rose from neutral to 55, signalling “moderate greed”.

Kazakhstan’s president orders creation of a state crypto reserve

Kazakhstan will establish a state digital-assets fund to accumulate a strategic crypto reserve, president Kassym-Jomart Tokayev said.

The fund will be set up within the investment corporation of the National Bank of Kazakhstan. The authorities have included the initiative in a list of directives to accelerate the creation of a digital-assets ecosystem.

Tokayev also instructed the cabinet and the National Bank to develop an investment programme in high-tech sectors of up to $1bn.

A key step will be passing, by year-end, a banking law that will liberalise the circulation of digital assets and promote fintech.

The head of state announced the Al-Sana programme, intended to involve up to 100,000 students in high-tech projects. For schoolchildren, curricula on the basics of artificial intelligence will be developed, and teachers will receive special training in AI tools.

“Developing competencies in artificial intelligence should begin at school,” the president of Kazakhstan believes.

What to discuss with friends?

- “On the brink of a breakthrough”: a minor iPhone update and an AI translator in AirPods.

- The altseason index hit its highest since late 2024.

- Why does AI hallucinate? An OpenAI study.

- Mike Novogratz declared the start of “Solana season”.

Kyrgyzstan approves bill on a bitcoin reserve

Kyrgyzstan’s parliament approved the “On Virtual Assets” bill in three readings, regulating the country’s cryptocurrency market.

The bill defines key asset types, notably fiat-backed stablecoins and RWA tokens.

The president is empowered to set rules for the issuance, circulation and regulation of cryptocurrencies. Regulatory sandboxes are introduced for testing innovative services and technologies.

It also provides for creating a state cryptocurrency reserve and launching mining using state infrastructure and resources. Participants must register and meet equipment requirements.

Gemini raises $425m in its IPO

On September 12, the Winklevoss brothers’ exchange Gemini held an IPO, raising $425m.

The venue sold 15.18m Class A shares at $28—above the planned $24–26 range. Listing under the ticker GEMI took place on Nasdaq with the support of Goldman Sachs, Citigroup, Morgan Stanley and Cantor.

Underwriters received a 30-day option to buy an additional 750,000 shares to cover over-allotments. Nasdaq bought $50m of stock in a private placement. Up to 10% of the offering was reserved for insiders and long-term Gemini users. Retail investors obtained up to 30% of shares via Robinhood, SoFi and Webull.

According to Bloomberg, the Winklevoss brothers will retain 94.5% of voting rights after the IPO. The exchange filed for the listing in March.

Reuters reported heavy investor demand, with orders running 20 times the available shares.

At the end of its debut session the stock closed at $32, 14.3% above the opening price. Market capitalisation stood at $3.8bn. Intraday, the shares touched $45.9 and the company’s valuation $4.4bn.

Experts assess Belarus’s prospects as a regional crypto hub

On September 9, a meeting was held between President Alexander Lukashenko, the National Bank’s staff and bank executives. At the session, the head of state said commercial financial institutions should more actively deploy digital assets to support external payments.

“Over the past five years, the economy, and with it the Belarusian banking sector, have faced unprecedented challenges. The government and the National Bank have been given the relevant instructions. Now act,” he said.

Days earlier, Lukashenko had already held a meeting on cryptocurrencies. He called for clear and transparent rules and market oversight mechanisms for digital assets, citing the economic downturn caused by EU and US sanctions.

“It is important for us not to lose sight of trends and not to forfeit our technological leadership. Naturally, those who set trends reap the greatest benefit. God willing, we will manage to set this trend and, in this regard, not put the cart before the horse,” the president said.

Andrey Tugarin, founder of GMT Legal, told ForkLog that the rules in force in Belarus create legitimate conditions for crypto exchanges and exchangers.

“The chosen regulatory approach cannot be called spontaneous or a chase after trends; everything is proceeding quite consistently,” the expert added.

In his view, further legislative initiatives “will only increase Belarus’s attractiveness, both for investment and for innovation”.

Ignat Likhunov, founder of the legal agency Cartesius, pointed to a fundamental contradiction. On the one hand, the authorities seek to create an attractive regulatory environment to draw foreign investment into the crypto sector. On the other, the active adoption of digital assets carries risks of macroeconomic destabilisation.

Discussing Belarus’s potential as a regional crypto hub, Likhunov noted both advantages and serious obstacles.

Clear positives include early regulation, tax incentives and support for mining. Negatives include restrictions for ordinary users, such as the ban on P2P operations and other tighter rules.

Also on ForkLog:

- AI startup Anthropic will pay $1.5bn to book authors for piracy.

- BitChat kept communications running during protests in Indonesia and Nepal.

- Engineers devised a way to send bitcoin to Mars.

- Sam Altman on jobs lost to AI and the tragedy involving a former OpenAI employee — an interview.

Tether unveils a US-market stablecoin

Tether will issue a dollar-backed stablecoin, fully regulated in the United States, dubbed USAT.

The American unit, Tether USAT, will be headed by Bo Hines—a former executive director of the Cryptocurrency Advisory Council under President Donald Trump.

The stablecoin will use the technology of Tether’s RWA platform Hadron.

The issuer, fully compliant with the GENIUS Act, will be the federally licensed crypto bank Anchorage Digital. Cantor Fitzgerald will serve as custodian of reserves and the primary dealer.

Undeads Games TVL tops $30m; token up 20x since the start of the year

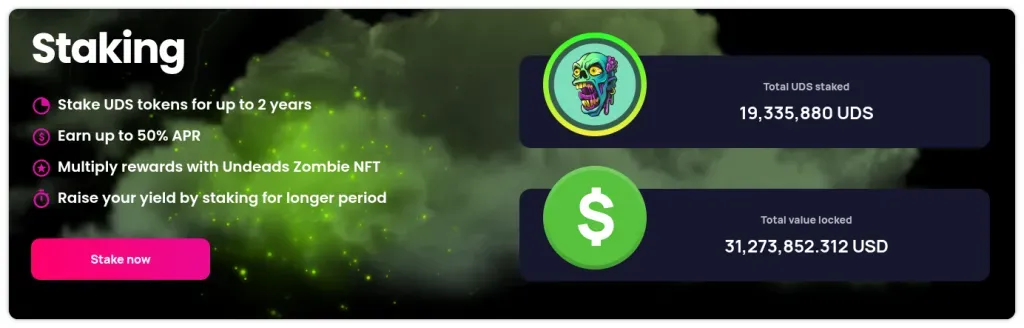

The value of tokens locked in staking for Undeads Games (UDS) reached $30m, project representatives told ForkLog.

According to the site, participants in the Dual Staking programme can earn up to 50% annually by using NFT boosters from the project’s collection. The higher the rarity of the non-fungible token, the higher the APR.

Since January 2025, UDS has climbed from $0.08 to $1.61, a more than 20-fold increase. The project’s FDV has exceeded $400m, according to CoinMarketCap.

UDS trades on MEXC, Gate and BingX. Daily volume exceeds $1m.

Undeads Games is a multi-genre gaming company focused on play-to-earn mechanics in a post-apocalyptic universe.

The company’s flagship product is an MMORPG in a zombie setting where players can earn cryptocurrency. The game’s release is scheduled for October 2025. The team will announce the exact date in the coming weeks.

What else to read?

We explain how the payments landscape is changing globally and the place digital assets occupy in it.

We examine the technical and legal aspects of the World Gold Council’s initiative to tokenise the precious metal.

We discuss in an interview with cypherpunk Anton Nesterov the main threats to privacy and how cryptography can counter them.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!