Cryptocurrencies are considered a high-risk asset class. Investing in them may result in the loss of part or all of your capital. The content on this website is intended solely for informational and educational use and should not be interpreted as financial or investment advice.

The Bitcoin price prediction scenario is getting weaker as BTC corrects nearly 10% from its recent swing high.

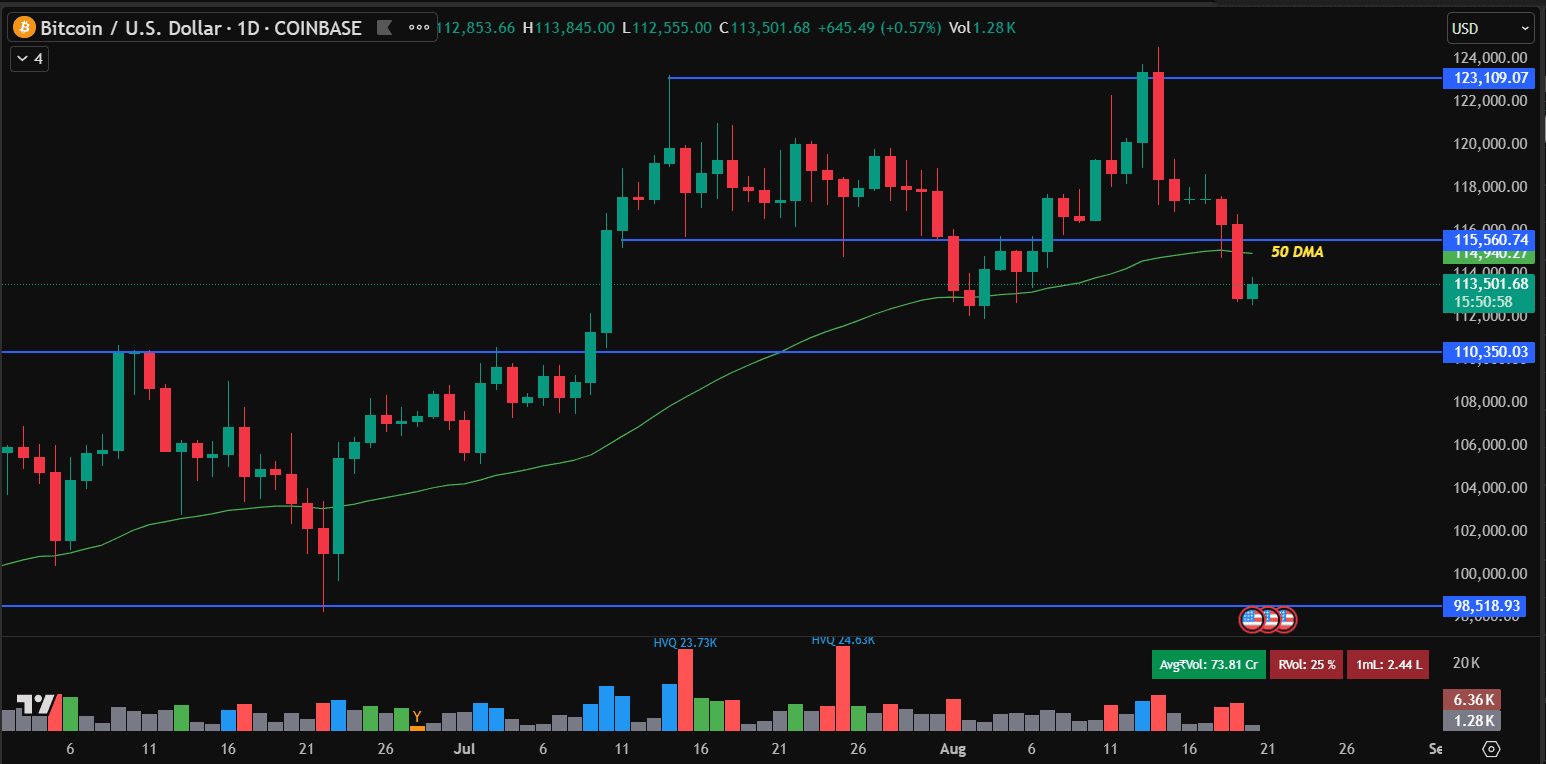

Bitcoin reached a fresh all-time high of $124,544 on August 14th, but after a brief breakout, it has declined to form a weekly low of $112,555, driven by broader market profit booking and weak macro indicators.

On Tuesday’s breakdown, it also fell below the crucial support of the 50-day moving average, which could now act as a potential resistance level.

While this drawdown is a natural reaction to the previous rally, the upcoming Federal Reserve meeting could significantly impact the Bitcoin price. The crypto market has been in bullish mode, pricing in the narrative of aggressive rate cuts, but the hopes are now fading as inflation data posted mixed sentiments, and employment numbers were substantial.

As the broader market faces correction with headwinds and macroeconomic uncertainty, layer 2 infrastructure projects are driving excitement, including the first Bitcoin layer-2 – Bitcoin Hyper, enhancing the overall utility and scalability of BTC.

Bitcoin Price Technical Levels: 50-DMA Lost, But $110k Still Intact

On the weekly timeframe, BTC has dropped 4.73% and is currently hovering above the key support level of $112,500. This level has previously acted as a demand zone when Bitcoin corrected in early August.

However, this time the 50-day moving average support level has been lost, which was around $116,000 level. Analysts are cautiously tracking the $110,000 support level, which is a decisive point for a breakout or breakdown.

Recent analysis by Bitcoin Rambo indicates signs of weakness in the current price action, as it has broken down through a key Fibonacci level and the 4H 200 trend. He also mentioned that a breakdown below $112,000 level won’t be surprising.

BTC 4H Chart

Although I generally maintain a bullish bias, the current setup is showing clear bearish signals. Price has broken down through a key Fib level and the 4H 200 trend, with today’s move appearing to be a clean breakdown and retest. Momentum remains weak, and… pic.twitter.com/0eIbiDZV8l

— Bitcoin Rambo (@TheBtcRambo) August 19, 2025

However, many experts believe that this is just a healthy market correction, and Bitcoin price prediction might show a decisive direction soon.

Jackson Hole Speech Could Decide Bitcoin’s Next Move

The upcoming Jerome Powell’s Jackson Hole speech on Friday has become a significant focus point for the crypto market. Markets have rallied in recent weeks on the back of aggressive rate cut expectations, with investors pricing in nearly 100 basis points of easing by the Fed in 2025. But hopes have been crushed as now a quarter-point cut is also tricky.

All Jackson hole symposiums of this cycle. #Bitcoin pic.twitter.com/GXskDRX6K9

— Hamza (@Itsdehamza) August 18, 2025

The Fed’s interest rates strongly influence Bitcoin and the entire crypto market. Lower interest rates usually boost risk assets like crypto because they look more attractive than traditional, safer assets. But when hopes of rate cuts fade, Bitcoin loses the significant tailwind of the rally.

The upcoming Jackson Hole speech will give a Fed interest rate outlook for the year. The Bitcoin price will likely crash if Powell delivers a highly hawkish statement, while a rate cut approach could drive a bullish Bitcoin price prediction.

Bitcoin Hyper: Presale Near $11 Million As BTC Capital Rotates

While Bitcoin corrects, Bitcoin Hyper is taking the centre stage. It is the first layer-2 protocol on the Bitcoin ecosystem, which is bringing fast speed, low-cost smart contracts, dApps, and memes on BTC’s 2 trillion dormant capital.

The platform is powered by Solana Virtual Machine (SVM) to bring a similar throughput to Solana directly onto Bitcoin’s security base layer.

The mission is proving successful, with its token presale already raising $10.8 million in early backing, showing strong investor confidence even as BTC falls.

Instead of staying limited to simple transfers, Bitcoin can now run DeFi apps, fuel games, support NFTs, and more. The process is simple: lock BTC in a bridge, and Bitcoin Hyper instantly issues an equal amount of wrapped BTC. This wrapped form expands Bitcoin’s use beyond what the main chain allows.

The highly undervalued price of the HYPER token is the major highlight. In the ongoing presale, investors can snag tokens at just $0.012765 per piece. However, the demand is increasing as the price will rise as the presale advances through stages.

Investors who believe in Bitcoin’s long-term growth but want faster, explosive returns can explore Bitcoin Hyper.