Bitcoin dropped below $100,000 in the early hours of this morning, marking yet another local low and its cheapest price since June 22. Is this the start of a bear market for BTC, or a retest of a crucial level ahead of a recovery?

The move downward is only fueling the fearful sentiment currently circulating in the crypto market. And with the wounds from October’s mass liquidation event still open, as well as the ongoing US government shutdown, there’s little sign of relief – at least for now.

That said, there are still pockets of activity within the crypto market attracting capital flows and demonstrating resilience. One project that has continued to draw attention is Bitcoin Hyper (HYPER), a new Layer 2 blockchain for Bitcoin.

Currently undergoing a presale, this project has raised north of $25.8 million so far, and received almost $100,000 in inflows in the past 24 hours. So why is HYPER continuing with business as usual despite the broad market dip? Let’s take a look.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

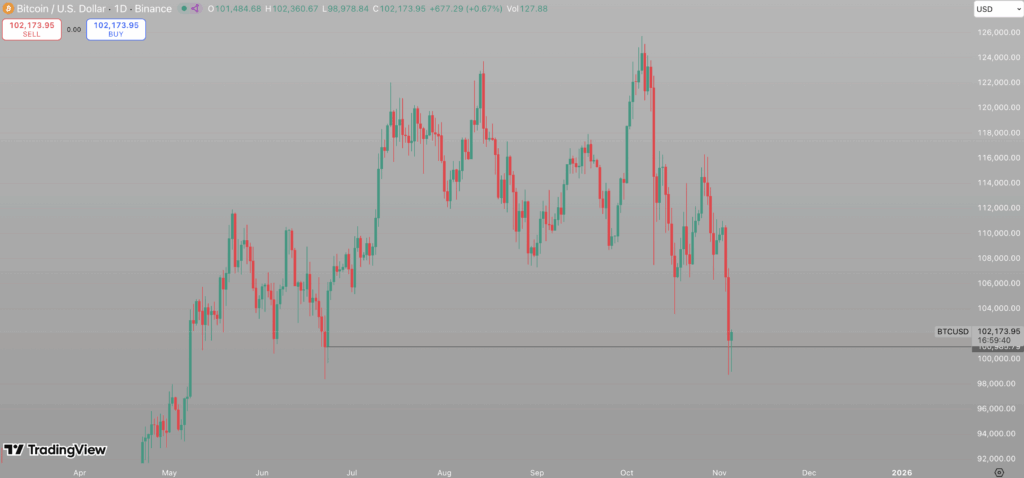

Bulls Call For Rebound as Bitcoin Wicks to $99,000

Bitcoin tapped lows around $99,000 on exchanges on Wednesday, falling to price levels last seen in June. While it has slightly recovered since, bouncing back up to $102,000, it’s clearly another major blow to the already spiralling sentiment among investors.

A scar left by October’s mass liquidation event, alongside continued macroeconomic uncertainty amid the US shutdown extending beyond expectations, and a decline in equity prices on Monday all contributed to the latest leg down.

Bitcoin’s price is currently down 1.8% from 24 hours ago and 9.7% from seven days ago. This move was once again fueled by an exodus of long positions, with CoinGlass reporting $2.1 billion in liquidations over the past 24 hours, of which $1.68 billion was for longs.

Furthermore, Farside Investors‘ data shows that Bitcoin ETFs posted another $566 million in outflows on Tuesday, marking the largest outflow in recent history.

So, is it all over? The short answer is: not quite. The prominent analyst Shardi B noted a turnaround within the futures market, amid signs that BTC could hit a quick rebound if bulls can maintain support at $100,000.

And here’s something else: the TradingView chart below quite clearly shows long wicks to the downside for Bitcoin around the $100,000 level. This suggests investor enthusiasm around $100,000, and bulls might finally be saying, “Enough is enough.”

The outlook for Bitcoin isn’t exactly bullish – but it’s far from catastrophic. A few years ago, few would have imagined the market showing this much fear with BTC hovering around the $100,000 mark. Yet even with the current uncertainty, some projects continue to buck the trend and attract inflows. Bitcoin Hyper stands as one of the assets still building momentum amid broader market weakness.

Best Crypto to Buy Now: Bitcoin Hyper Clears $25.8M Presale Raise

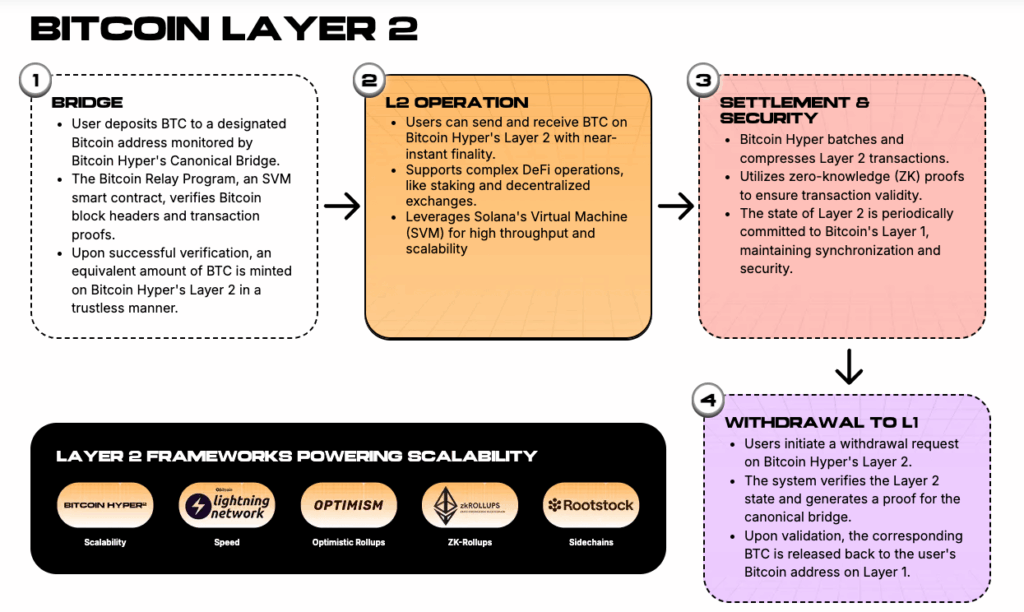

While the market is obsessing about BTC’s price, Bitcoin Hyper (HYPER) is quietly building fundamentals that could outlast any short-term volatility. It’s creating a Bitcoin Layer 2 blockchain to tackle the network’s pressing issues of slow speeds, high fees, and limited functionality.

Bitcoin Hyper runs on the Solana Virtual Machine, which means it can process tens of thousands of transactions per second – and support smart contracts – while being backed by Bitcoin’s security and immutability.

The HYPER presale has recently exceeded the $25.8 million raised milestone, adding almost $100,000 in the past 24 hours. This level of momentum at a time when most cryptos are struggling is a clear testament to both HYPER’s strength and its upside potential if a full market rebound does ensue.

Some top analysts remain highly bullish on the project despite the dip, with Borch Crypto suggesting it could give 100x gains once it hits exchanges. Indeed, such returns would likely require a full Bitcoin recovery, but BTC’s reaction around $100,000 suggests this can’t be ruled out.

What’s Next for Bitcoin Hyper?

Providing that Bitcoin’s $100,000 support and key moving averages hold up, crypto remains in a bull market. It makes sense that traders are derisking and taking profits right now – but those who position in strong-performing, undervalued alts may reap huge rewards if a recovery takes place. Bitcoin Hyper’s current early-stage status and relative strength signal it could be among the top performers.

The HYPER token is currently available at $0.013225 via its presale (with staking available at a 45% APY), but this price will increase as the campaign progresses. The next uptick is in less than two days, so those seeking the best possible entry have no time to waste.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.